New data reveals the Melbourne suburbs with the biggest price gaps and the strongest potential for rapid property growth. Photo: Tony Gough

Melbourne is “tremendously undervalued” and overdue for a boom, with new research showing which suburbs could be set for some of the biggest jumps.

Experts are tipping this year’s third Reserve Bank rate cut could finally be the one to turn the city’s housing fortunes around, and areas like St Kilda East, Noble Park and Doreen are poised to get the best boost.

The analysis from SuburbData tracked demand-to-supply ratios, price gaps with neighbouring suburbs, as well as the difference between house and unit prices to pinpoint postcodes primed for the next growth spurt.

RELATED: AFL great Tom Hafey’s Sorrento secret revealed

Shock reason two-bed unit had buyers fly in

‘F**king nice house’ goes viral

St Kilda East leads the pack, with typical house values a staggering $348,000 cheaper than nearby bayside postcodes.

Noble Park and Doreen are also trading at steep discounts compared to their neighbours, despite strong transport, shopping and schooling options.

SuburbData director Jeremy Sheppard said knowing where value lay in Melbourne’s market was critical.

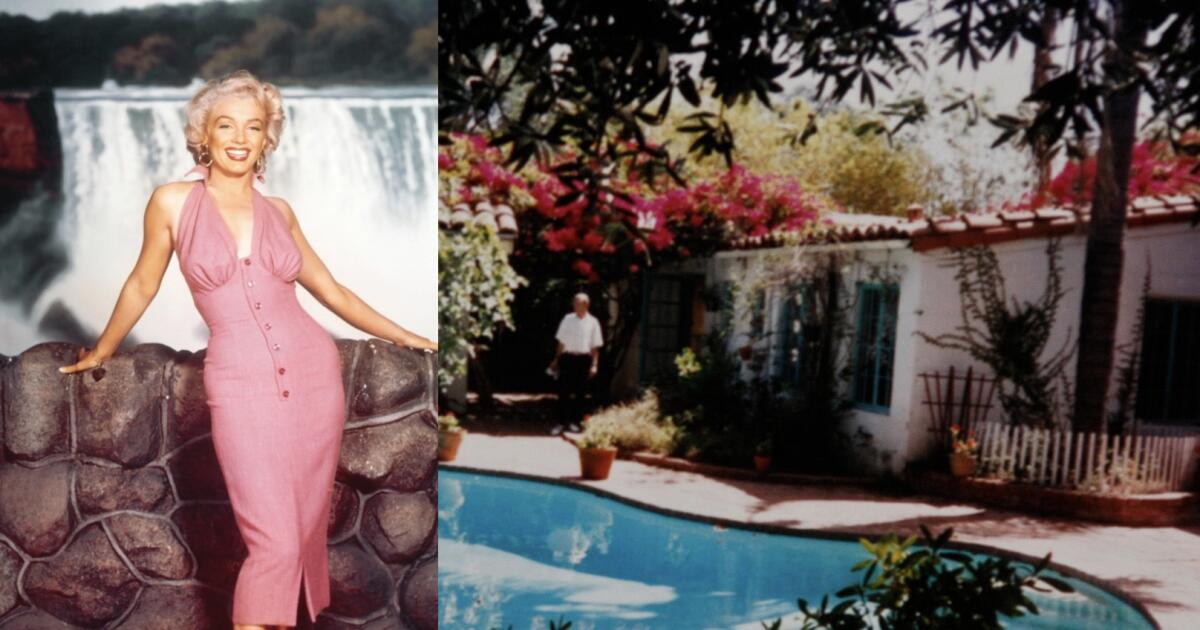

Jeremy Sheppard of Suburb Trends says Melbourne is “tremendously undervalued”.

“Melbourne is tremendously undervalued … homes have become such an enormous investment … families need to be cannier about where they buy,” Mr Sheppard said.

He added that undervalued suburbs were often those priced below neighbouring areas without clear geographic disadvantages, where growth had been lacklustre while nearby markets surged, and where buyer demand was now starting to outweigh supply.

“When buyers find better value for money in a market, that’s when you get a feeding frenzy,” Mr Sheppard said.

“It may take a while till you get any growth on your investment in an overvalued suburb … buying at the peak of a fast moving market could even mean, in extreme cases, that prices soon fall.”

Prominent Bayside real estate director Gary Peer says St Kilda East’s median price has been softened by years of high apartment sales and investor exits.

Prominent Bayside real estate director Gary Peer said the median price in St Kilda East was “heavily influenced by apartment sales”.

“St Kilda East is absolutely prolific when it comes to apartments, historically it’s been a hotspot for investors,” Mr Peer said.

“But over the past few years, many investors have exited the market for a variety of reasons.

“The rapid rise in interest rates was a big one — though we’re now starting to get some relief. Land tax has also bitten hard.”

Analysis shows St Kilda East houses are $348,000 cheaper than neighbouring bayside suburbs with similar lifestyle appeal. Graphic: Google Gemini/Canva.

The Gary Peer Real Estate boss said the result of that investor exodus has been a shift in the buyer pool, and coupled with high numbers of sales it had led to softer price growth in the suburb.

“Compared to five years ago, prices in St Kilda East haven’t climbed the way we might have expected,” Mr Peer said

“In some cases they’ve stayed flat or even gone backwards — and that’s rare in Melbourne.”

He noted that the suburb was still a “premier address” and “as affordable as St Kilda East is likely to be for years”.

Whitefox chief executive Marty Fox predicts six-figure price gaps won’t last once buyers realise the suburb’s lifestyle and transport advantages.

Research has pinpointed Melbourne’s most undervalued postcodes, where affordability, infrastructure and amenity could trigger a market surge. Photo: Nicki Connolly.

Whitefox chief executive and The Block judge Marty Fox said the relative affordability, especially the six-figure gap between St Kilda East and neighbouring areas, wouldn’t last long.

“Historically, these kinds of disparities don’t survive long once buyers start connecting the dots on lifestyle, transport, and amenity,” Mr Fox said.

“Once demand tips, you can see 10-15 per cent lifts inside a year, especially if there’s a catalyst like infrastructure upgrades, a rate cut, or just the media finally catching on.”

Melbourne’s fundamentals are also likely to help drive prices up in undervalued areas.

An aerial view of St Kilda East, Melbourne’s most undervalued suburb, located minutes from bayside and the CBD. Photo: NearMap.

“You’ve got population growth back at pace, rental supply at record lows, and construction costs pushing replacement values higher,” Mr Fox said.

“The gap between what buyers think property is worth and what it should be worth is the widest I’ve seen in years, and that’s an opportunity for those who aren’t scared to act before the crowd catches on.”

Tuesday’s interest rate cut, while important, was not the only factor in a boost to home values.

“Cheaper money acts like lighter fluid on buyer intent, but the spark will be confidence,” Mr Fox said.

Areas where home values are significantly cheaper than neighbouring suburbs

St Kilda East $1.2m – $348,000 cheaper

Box Hill North $1.4m – $135,000 cheaper

Doreen $788,000 – $49,000 cheaper

Noble Park $794,000 – $42,000 cheaper

Kings Park $682,000 – $39,000 cheaper

St Albans $721,000 – $34,000 cheaper

Deer Park $653,000 – $35,000 cheaper

Officer $756,000 – $32,000 cheaper

Westmeadows $765,000 – $6000 cheaper

Mickleham $714,000 – $2000 cheaper

Source: SuburbData, June 2025, suburbs ranked using a blend of demand, supply, and price gap metrics compared with neighbouring areas.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Bold French move puts $15m+ price on Melb home

English (US) ·

English (US) ·