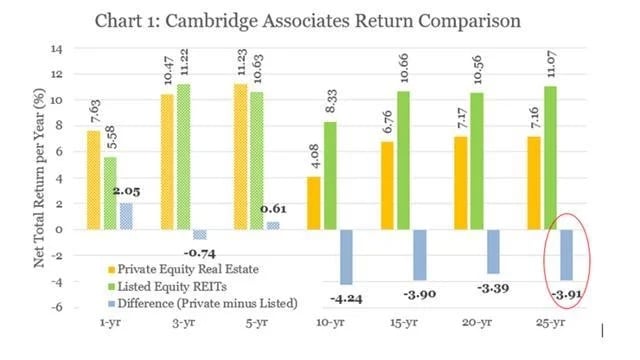

Recently, we shared “8 Reasons Why REITs Are More Rewarding Than Rentals.” In short, studies show that REITs earn 2% to 4% higher annual returns than private real estate. There are eight reasons for this:

- REITs enjoy huge economies of scale.

- They can grow externally.

- They can develop their own properties.

- They can earn additional profits by monetizing their platform.

- They enjoy stronger bargaining power with their tenants.

- They benefit from off-market deals on a much larger scale.

- They have the best talent.

- They avoid disastrous outcomes.

Private equity real estate compared to listed equity REITs as net total return per year over 25 years – Cambridge Associates

Private equity real estate compared to listed equity REITs as net total return per year over 25 years – Cambridge AssociatesBut higher returns also mean higher risk, right? That is why a lot of rental property investors stay away from REITs. They perceive them as being a lot riskier than rental properties because they trade in the form of stocks, and this comes with significant volatility. But I disagree.

I think that REITs are far safer investments than rental properties. Here are six reasons why.

Concentration vs. Diversification

Rental properties are big-ticket investments. Therefore, most investors end up owning just one or a few.

As a result, you are highly concentrated on a limited number of individual properties, tenants, and markets. If you suffer bad luck, you could face significant losses because you aren’t diversified.

A tenant trashing your home, a leaking pipe, an insurance company failing to cover you, a big property tax hike, poor local market conditions, a tenant sues you: These things happen, and that is why diversification is key to mitigating risks.

REITs, on the other hand, own hundreds, if not thousands, of properties, which results in great diversification by property, tenant, and market. Beyond that, there are ~1,000 REITs worldwide investing in 20+ different property sectors and 20+ countries, allowing investors to build extremely well-diversified portfolios that can withstand the test of time.

Private vs. Public

Rental properties are private investments, making them relatively illiquid, less transparent, and subject to inconsistent regulation, which can increase the risk of scams. Accessing reliable information is often more complicated, investor protections are limited, and many people may attempt to take advantage of the market’s opacity.

REITs, on the other hand, are public, liquid, transparent, SEC regulated, and scrutinized by countless analysts, inducing short-sellers and lawyers who are looking for the smallest issue to go after the company.

The risk of buying a private property and overpaying for it, because you lacked some key information, is much greater, and selling it in the future will also be a lot more complex and expensive, given its illiquid nature.

High Leverage vs. Low Leverage

Most rental property investors will commonly use ~80% leverage when buying properties. This means that a 10% drop in property value would lead to a 50% loss in equity value.

This explains why so many property investors filed for bankruptcy during the great financial crisis. As property prices crashed, a lot of investors ended up with negative equity in their properties and then returned the keys to their lenders—a complete wipeout.

In comparison, REITs are far more conservative because they have learned their lesson from those experiences. They typically only use 30% to 50% leverage, depending on the property type. This leads to lower risk in case of a downturn.

Personal Liability vs. Limited Liability

A major risk many rental property investors underappreciate, in my opinion, is liability.

You may think an LLC and/or insurance will protect you from everything, but that simply isn’t true. The bank will likely still require personal liability when you take out a mortgage, and your tenants or contractors may still sue you personally if they believe you are responsible for issues that arise.

For example, let’s assume that some mold grows into your bathroom, and your tenant eventually develops a disease as a result. Even if it isn’t your fault, the tenant may still sue you personally, leading to lots of headaches, sleepless nights, and major legal bills at a minimum.

With REITs, your liability is protected because you are just a minority shareholder of a publicly listed company. You are not actually signing on any of the loans personally, but you still enjoy their benefit. The tenants also won’t ever sue you directly, and you cannot lose more than your equity in a worst-case scenario.

Social Risk vs. Shielded From Operations

Real estate investing is a people business, and it comes with social risk. There are lots of people who like to take advantage of property owners, and this could lead to significant emotional or even physical pain.

I know people who have been physically threatened by their tenants. While it is rare, there are also cases of tenants assaulting or even killing their landlords. There are countless cases of tenants refusing to pay their rent, intentionally damaging the property, and/or squatting and refusing to move out.

All of this could literally ruin your life and cause such stress that your mental and physical health takes a hit. You may think that you can avoid this by simply being selective and only renting to the best tenants, but people will lie and change over time. If you are a landlord long enough, you will likely eventually have to deal with such issues.

In my mind, the potential returns of rental investing are almost never worth running this risk.

I would much rather earn a slightly lower return and be completely shielded from the operations, with a professional handling everything on my behalf. You could, of course, hire a property manager, but that would come at a steep cost because you won’t enjoy the same scale as REITs.

In comparison, REITs can handle the management in a much more cost-efficient way because of their scale advantage, and they completely shield you from these operational risks.

No Quotation vs. Daily Quotation

Finally, if you think REITs are much more volatile than rental properties, think again. The reason why you think that property values are more stable than the share prices of REITs is because you are comparing the total asset value of a rental to the equity value of REITs, which is apples to oranges.

Instead, you should be comparing the volatility of your own equity value to the volatility of the share prices of REITs. If you did that, you would quickly realize that REITs are far more stable in most cases.

As noted, if you are using an 80% loan-to-value, then you only have 20% equity in the property. This means that a 10% lower property value would cause your equity value to crash by 50%. A 20% drop would lead to a complete wipeout.

Now ask yourself: If you own a private, illiquid, concentrated asset with a single tenant, high capex, and social risk, how likely is it that your property could face such setbacks? The answer is that it is very high.

A leaking roof causing water damage could easily decrease your property value by 5% to 10%, meaning that your equity value would drop by 25% to 50%. A tenant stopping to pay rent, refusing to move out, and trashing your place? That’s an easy 10% to 50%+ drop in equity value.

Even if you don’t face any issues, your property is illiquid, and information is not transparent. Therefore, its value is much more uncertain. So, if you were taking offers on a daily basis (like the stock market), you would commonly get offers 10% to 20% lower than your estimated value, resulting in extreme volatility in your equity value.

Just because you are not actually getting a daily quote and are ignoring these offers does not mean that your equity value is perfectly stable.

Now compare that to REITs. What you see traded is the equity value, and while it does fluctuate, in most cases, it’s not to the same extent.

Again, it makes sense that REITs would be less volatile, given that they are large, diversified, public, and liquid companies that are SEC-regulated, and there is ample information about them and coverage from countless professional analysts. It is then a lot easier for the market to determine the right price, and it won’t need to fluctuate as much.

A study by Brad Case, CFA, PhD found that REITs are 17% less volatile than private real estate when the right adjustments are made for an apples-to-apples comparison.

Final Thoughts

Rental properties are concentrated, private, illiquid, highly leveraged investments with liability issues and social risk.

Meanwhile, REITs are diversified, public, liquid, moderately leveraged investments that enjoy limited liability and professional management.

It is night and day in terms of risks. Rentals are far riskier than REIT investments, and anyone who argues against this is misinformed, in my opinion

This is also well-reflected in the rates of bankruptcies.

There are countless real estate investors who file for bankruptcy each year, yet only a handful of REIT bankruptcies have occurred over the past few decades.

Invest Smarter with PassivePockets

Access education, private investor forums, and sponsor & deal directories — so you can confidently find, vet, and invest in syndications.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

English (US) ·

English (US) ·