Is your serene street suddenly jammed with cars because of an open house next door? Does a ‘Sale Pending’ sign materialize on your neighbor’s yard a few days after a “For Sale” sign appears? Do your friends grumble about how many offers they’ve submitted on homes to no avail?

If these scenarios ring true, chances are you’re in the midst of a seller’s market. A seller’s market exists when there are more homebuyers than available homes. In this type of market, sellers have an advantage in negotiating better deals — they’re likely to sell their homes faster and for more money than they would be able to in a buyer’s market.

How Much Is Your Home Worth Now?

Home values have rapidly increased in recent years. How much is your current home worth now? Get a ballpark estimate from HomeLight’s free Home Value Estimator.

We’ll break down the factors that contribute to a seller’s market with help from Kenneth Bryant, a West Virginia real estate agent with over 30 years of industry experience. He explains what a seller’s market looks like and what to expect if you’re a homeowner thinking about selling in these ideal conditions.

Seller’s market 101: the rules of supply and demand

In any commodity market, there are sellers, and there are buyers. Sellers furnish the supply, while buyers represent demand in the marketplace. When a market is balanced, the amount of supply and demand is the same. But when one side of the equation — supply or demand — exceeds the other, the balance shifts to the other’s benefit.

In real estate, housing inventory represents the supply, and homebuyers, the demand. When there’s a shortage of homes, homebuyers compete for a limited number of homes. This competition gives sellers leverage to negotiate for a higher sales price and better offer terms, such as fewer contingencies.

The following factors shift housing inventory and buyer demand to favor sellers:

Low housing inventory

Lack of supply is a significant factor that contributes to a seller’s market. Let’s take a look at some factors that may contribute to an inventory shortage:

- An insufficient supply of new builds to close the gap:

When builders aren’t keeping up with buyer demand, the result intensifies a housing imbalance. At its height in 2005, builders broke ground on more than 1.7 million single-family homes. Then the 2008 Great Recession wiped out buyer demand, resulting in the lowest point for housing starts in 2009. As of November 2024, the seasonally adjusted annual rate for housing starts stood at 1.289 million. Even with a national housing shortage of 3.7 million, rising construction costs impact home builds. - Zoning restrictions cause building delays or thwart construction completely:

Many cities limit new housing with strict zoning laws and building regulations. Suburban areas with zoning restrictions often limit building density, prohibiting multi-family properties and mandating larger lot sizes. With these restrictions, builders prefer to build large luxury homes or residential complexes instead of more affordable multi-family housing that could accommodate more people on the same plot of land. And in extreme cases, communities bent on preserving open land struggle with balancing conservation and demand for housing. For example, in Lexington, Kentucky, new building starts must comply with zoning regulations on building heights, lot sizes, and the number of units per lot, among other guidelines. - Boomers decide to downsize later in life:

When an aging generation chooses not to downsize, or to downsize at a later time, fewer homes become available to resale buyers. The National Association of Realtors’ (NAR) 2024 Home Buyers and Sellers Generational Trends reveal that Younger Boomers aged 59 to 68 expect to own their homes for the longest period of time — 20 years. Sellers aged 69 to 77 years were most likely to downsize their home.

The sheer number of retirees — experts estimate this growing population will reach 80 million in 2040 — could be enough to keep inventory low by locking up homes that would otherwise be re-sold to younger buyers.

High buyer demand

Along with housing scarcity, a seller’s market thrives on strong buyer demand. Financial, economic, lifestyle, and demographic factors all play a role in shifting buyer demand. Buyer demand may be influenced by:

- Low mortgage interest rates:

Homebuyers benefit from a slight boost in spending power when interest rates drop, while they choose to wait and see when interest rates increase. When rates dip, so do interest charges. Monthly mortgage payments drop along with them. The U.S. Federal Reserve, the country’s central bank, controls interest rates. It uses interest rates as a lever to maintain economic stability. In a troubling economy, the Fed pushes rates down, encouraging people and businesses to spend by making it cheaper to borrow money for new cars, electronics — and homes. - Regional economic prosperity:

Homebuyers are more likely to emerge in a robust local economy when wallets and bank accounts are flush. Bryant tells us that a boon in the local job market encourages buyers and attracts people from outside the region. “That’s going to create a lot of desire to purchase,” he says. “When you move for a job, you’re hoping that’s a long-term proposition.” - Surges in generational demand for homes:

Shifting demographics can contribute to an influx of buyers. By 2030, the age group most likely to settle in the suburbs, ages 34 to 43, will reach 78 million. These millennial buyers had been lying low in the aftermath of the 2008 Great Recession. But that’s changing. According to a 2024 survey by the NAR, millennials from 25 to 43 years old make up the largest percentage of homebuyers at 38%. NAR data shows the average age of a first-time homebuyer is now at an all-time high of 38. The average age was in the late 20s in the 1980s.

Are you in a seller’s market? Keep an eye on these signs

Your neighbors put their house on the market on a Friday, and a “Sold” sign appeared on Monday. Was it a fluke or a sign that it’s a seller’s market? Follow these metrics to find out.

Just keep in mind that these statistics are relative to your geographic market. Reach out to a local real estate agent to gauge what average market stats are for your area.

- Months’ supply of inventory:

This statistic gives you a snapshot of buyer demand. The calculation measures how quickly homes on the market would last if no new homes became available. For the average market, four to six months’ supply is generally considered a balanced market. In markets with fewer months’ supply, the data points to a seller’s market. Supply that exceeds six months indicates a buyer’s market. To calculate the months’ supply of inventory, divide the available properties for sale on the last day of the month by the number of home sales in the past month. For example, if there are 1,500 homes for sale and 500 pending sales, the market would have a three-month supply of homes. - How fast homes are selling:

The marketing time, or ‘days on market’ metric, indicates how long a home sits on the market before a buyer and seller agree on a purchase contract. Most experts consider it a balanced market when sales take four to six months. Fewer days signal a seller’s market. In a strong seller’s market, buyers snap up homes in weeks or days, not months. In December 2024, the median days on market in West Virginia was 70 days — less than three months. - Annual home price gains:

If home values in your area are growing by leaps and bounds, it’s another sign of a strong real estate market. Home sales price increased 4.8% in November 2024 compared to last year. In strong seller’s markets, it is possible to see double-digit gains.

For instance, leading up to the Great Recession, Seattle area home prices jumped 44% from 2004 to 2007, according to the Case-Schiller Home Price Index. Phoenix values grew by 54% in the same period.

What to know about selling in a seller’s market

If you have a coveted home to sell, and buyer demand is high, here’s what to expect listing in a seller’s market:

You’re more likely to receive multiple offers

When there are more buyers in the market than homes, buyers compete for what’s available. That situation often leads to more than one party placing an offer on your home. In an effort to juggle multiple offers, some listing agents stipulate an offer deadline for buyers so that the seller can review all offers at one time.

The best way to manage multiple offers? Partner with a top real estate agent who has significant experience negotiating home sale deals. Seller strategies for leveraging a multi-offer situation include:

- Inform buyers that they’re competing against other offers and asking them to submit their highest and best offer.

- Respond to one of the offers with a counter offer, setting other offers aside until you receive a response.

- Issue multiple counter offers to selected buyers. Proceed with caution to avoid accidentally selling your home to multiple parties. Laws for multiple counter offers vary by state.

Competing offers gives you leverage in negotiations

When a buyer finds out that other parties are bidding on their dream home, they’re more likely to accept the terms the seller wants. You can use the situation to your advantage and negotiate the best deal.

Notably, multiple offers may spark a bidding war that pushes the price upward. Along with increasing the offer price, buyers in competitive markets may sweeten the deal with other favorable terms — such as shortening or waiving contingencies and offering cash instead of financing for a faster close.

Your home may sell faster than you anticipate

If you list your home and think you’ll have time to leisurely sort through the stack of boxes in your garage for Goodwill donations, think again. In a seller’s market, properties sell fast.

NAR shares that during peak buying season, the median days on market is around 33 days. And some markets sell even faster. In the Seattle area, the median number of days to contract was 21 days in May 2024, according to the Federal Reserve Bank of St. Louis.

While you’re preparing your home to sell in a seller’s market, plan for your move, too. Pack items you don’t need, then sort through and donate old possessions. Figure out where you’ll live next. There’s a good chance you’ll be short on time when your home hits the market.

Identifying your next home could be tougher than you think, if you plan to buy

Finding the right buyer may seem like a breeze in a seller’s market, but don’t forget that you’ll need a new place to settle when the deal is done. If you decide to buy another home while in a seller’s market, the tables turn. You’ll experience the same market conditions but in the homebuyer’s shoes. With fewer homes on the market, searching for the right fit could take longer than you think. And when you do find the right house, there’s a chance another buyer could outbid you — putting you back at square one.

Before you accept an offer, map out a strategy for identifying and transitioning to your next home. Consider negotiating a rent back when you sell to give you extra time to find your new home.

Connect with a Top Agent

Regardless of market conditions and whether you’re buying or selling a home, working with a top real estate agent can be key to achieving your goals.

A seller’s market puts homeowners in an ideal situation

If you’ve done the math and find yourself in a seller’s market, consider your options as a homeowner. If you’ve been on the fence about making a move, taking advantage of a seller’s market seems like a no-brainer. Low inventory and eager buyers make it easier to sell your home for the best deal. Just remember to plan for where you’ll move next — because buying in a seller’s market isn’t as easy.

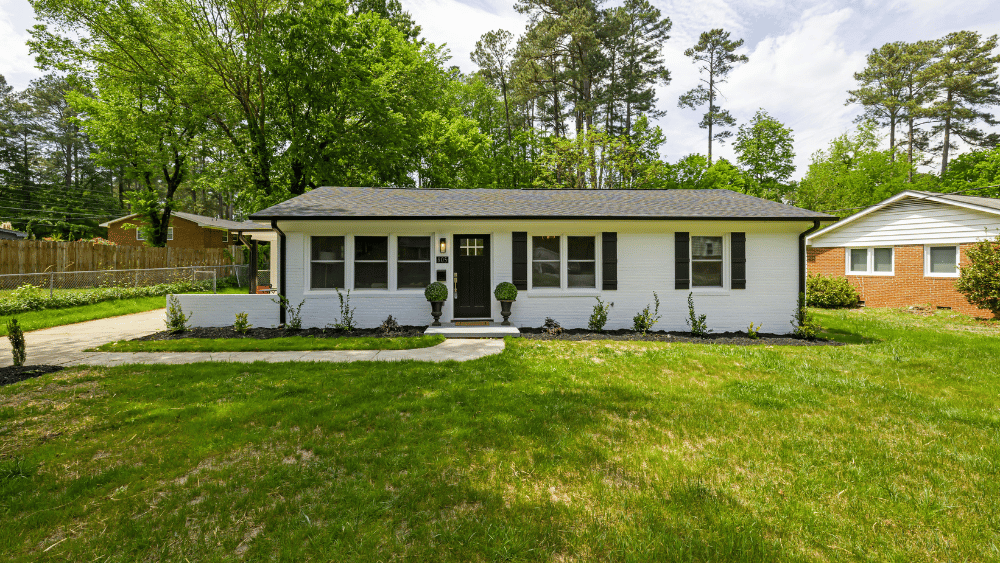

Header Image Source: (Ben Ruys / Unsplash)

- "Great Recession," History.com (October 2019)

- "MONTHLY NEW RESIDENTIAL CONSTRUCTION, NOVEMBER 2024," United States Census Bureau (December 2024)

- "Economic, Housing and Mortgage Market Outlook – November 2024 | Spotlight: Housing Supply," Freddie Mac (November 2024)

- "Land Use and Zoning Basics," FindLaw (June 2024)

- "Residential Zoning Laws and Regulations Lexington, KY in 2025," Steadily, Zoe Harper (June 2024)

- "2024 Home Buyers and Sellers Generational Trends Report," NAR (April 2024)

- "The US Population Is Aging," Urban Institute (January 2025)

- "Compare Today’s Mortgage Rates," Forbes, Caroline Basile (January 2025)

- "Millennials and Homebuying: Myths and Reality," Nerd Wallet (January 2016)

- "Housing Market Predictions For 2025: When Will Home Prices Drop?," Forbes, Robin Rothstein (January 2025)

English (US) ·

English (US) ·