Geelong’s property market is forecast to hold steady in 2025, providing solid conditions for first-home buyers and upgraders.

National property market analyst Propertyology predicts house price movement between -2 per cent and 1 per cent for the region over the next 12 months.

A 96 per cent surge in stock on the market over the past three years and lower transaction numbers are creating the stagnant conditions.

RELATED: Classic Lorne beach house selling for first time in 94 years

Geelong’s most popular property listings of 2024

Architects eye striking Queenscliff home with amazing views

32 Girton Cres, Manifold Heights, has just hit the market with $1.65m to $1.725m price hopes.

The firm’s head of research Simon Pressley said Geelong vendors would need to adjust their expectations for the foreseeable future, despite strong internal migration to the area.

“From 2009 onwards, the great regional city of Geelong has consistently been Victoria’s strongest ‘magnet’ for internal migration,” Mr Pressley said.

“But, like everywhere else in the state of Victoria, its property market is currently ‘soft’.

“There’s an elevated volume of housing stock on the market and buyer confidence has waned. This is best illustrated by the 20 per cent reduction in Geelong real estate transaction volumes, from 6615 in 2021 to 5340 last year.

“Vendors will need to continue to taper their expectations in 2025 (and beyond).”

Propertytology head of research Simon Pressley.

He said home upgraders were expected to be the most active buyer group in 2025, with more first-home buyers also expected to enter the market.

Nationally, first-home buyers rose 9 per cent to 117,000 last year, with that number expected to grow if the RBA cuts interest rates in 2025.

Propertyology’s 2025 Property Market Outlook, which forecast’s growth rates for Australia’s 25 largest cities, including Geelong, shows Victoria continues to lag behind the rest of the country.

It found 11 cities were likely to experience boom conditions in 2025, with 20 to produce positive growth.

Townsville is expected to be the strongest performer, with the median house price of $520,000 tipped to surge 25 to 30 per cent.

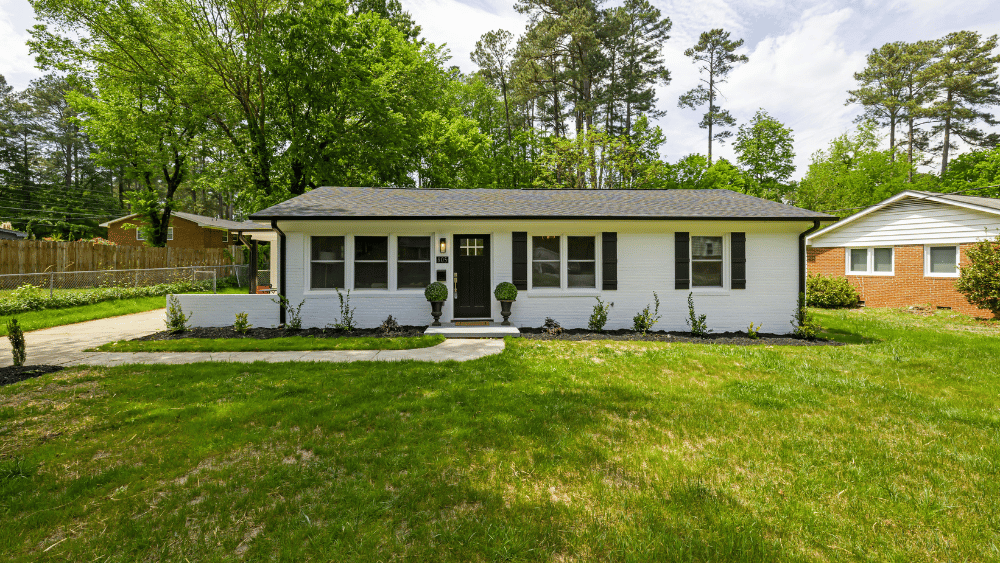

36 Pavo St, Belmont sold for $607,000 just before Christmas.

Propertyology’s 2025 Property Market Outlook graphic. Source: Propertyology, ABS

The Sunshine Coast comes in second, with likely price growth between 12 per cent and 16 per cent, on the back of a strong local economy and an active home upgrade market.

The report found three capital cities, Adelaide, Brisbane and Perth, are likely to achieve double-digit growth.

Conversely, a mild decline in home values is on the cards for Sydney and Melbourne.

Propertyology describes Victoria as “Australia’s problem child”.

“The start-to-finish of the state’s doldrums is likely to end up extending throughout the entire 2020s decade,” Mr Pressley said.

“Melbourne has already been the worst performed property market in the entire country over the past five years.”

English (US) ·

English (US) ·