Australia’s property market has officially reached fever pitch, with desperate homebuyers throwing caution to the wind and stripping crucial conditions from their offers in a bid to secure a home.

Alarming new data from Loan Market Group reveals mortgage pre-approvals have skyrocketed to unprecedented levels across the nation, fuelling a cut-throat environment where buyers are making unconditional offers, exposing themselves to massive financial risks.

The data shows an astonishing surge in pre-approvals, with Melbourne’s eastern suburb of Ringwood leading the charge, rocketing by an astounding 500 per cent when comparing the third quarter of 2025 to the same period last year.

RELATED

QLD: Property race sees Qld loan pre-approvals surge

SA: SA suburbs leading a lending boom

NSW: Nasty housing shock set to hit key parts of Sydney

VIC: Melb buyers spark six-fold home-loan surge

Brisbane’s Fortitude Valley recorded the second-highest jump nationally, up a staggering 373 per cent, while Surfers Paradise on the Gold Coast claimed third place with a 330 per cent increase.

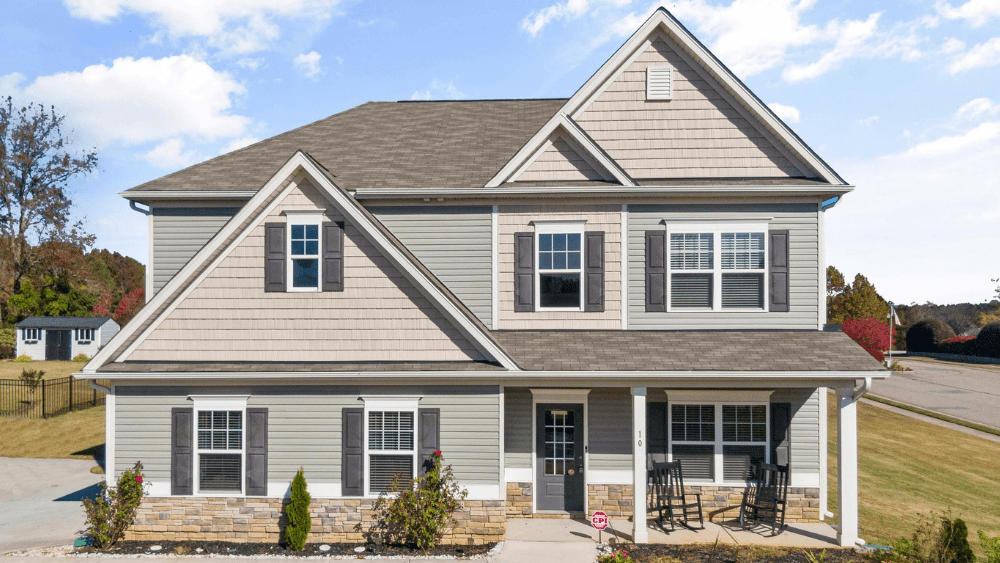

Desperate homebuyers are ditching all safeguards as pre-approvals explode by 500 per cent. Picture: Rohan Kelly

Melbourne’s Box Hill also saw a significant jump of 267 per cent in pre-approvals, and Sydney’s Hurstville rounded out the top five with an increase of 220 per cent.

The surge is widespread, with Adelaide’s Modbury experiencing a 160 per cent increase, Darwin at 171 per cent, and Hobart’s Park Grove recording a 71 per cent jump.

VICTORIA’S TOP 1O PRE-APPROVAL SUBURBS

VIC. Source: Loan Market Group

QUEENSLAND’S TOP 1O PRE-APPROVAL SUBURBS

QLD. Source: Loan Market Group

This unprecedented demand is largely attributed to a potent cocktail of rising property values, significant interest rate cuts by the Reserve Bank of Australia – a substantial 75 basis points this year – and the Australian Government’s 5 per cent Deposit Scheme for first homebuyers, which commenced this month.

Loan Market CEO David McQueen said these elements had supercharged the market, overwhelming banks and lenders with a flood of eager buyers.

“There’s a definite shift in sentiment and competition, with more people attending open homes and more properties selling under the hammer at auction,” he said.

“Since July, Loan Market has recorded a surge in people reaching out to brokers, securing a pre-approval before starting their property hunt – they’re looking for that crucial edge in a competitive market.

“In some markets, the number of people with pre-approvals has more than doubled, year-on-year. Knowing exactly how much you can borrow and repay helps you pinpoint the suburbs within your price range and confidently decide if that extra bedroom or bathroom is within your budget.

“As our data has shown, pre-approvals are being secured from the inner city to the outer suburbs, underlining the rising interest across many markets.”

NEW SOUTH WALES’ TOP 1O PRE-APPROVAL SUBURBS

NSW: Source: Loan Market Group

SOUTH AUSTRALIA’S TOP 1O PRE-APPROVAL SUBURBS

SA. Source: Loan Market Group

Ivan Dennis, Head of Analytics at Loan Market Group, expressed his surprise at the diverse range of suburbs on the list.

“I was surprised at some of the suburbs on the list,” Mr Dennis said.

“Some are high value, while others are on the fringes or remote. In Victoria for example, there are inner city and also fringe suburbs, both experiencing growth. Each state seems to have a different pattern.”

English (US) ·

English (US) ·