Compare the Market economic director David Koch says homeowners paying off a mortgage have carried the nation through the cost-of-living crisis.

Finance guru and former Sunrise host David Koch has warned the Reserve Bank’s rate cuts have not been enough, urging the peak body to go harder or face the consequences.

This after Compare the Market research showed the shock fallout of the RBA’s rate hikes on Australians whom Mr Koch said “carried the nation through the cost-of-living crisis”.

MORE: Aus landlord’s epic council battle ends in demolition

Explosive reform of negative gearing, capital gains perks

Mr Koch said it was time the Reserve Bank gave more back in bigger rate cuts. Picture: Christian Gilles / NewsWire

He said rate cuts of 0.25 per cent in February and May would have reduced monthly repayments by around $193, and another cut in August could push that figure to $307 – a reduction of $3,684 over a year.

Mr Koch said it was time for RBA to give people with a mortgage real break and a much bigger cut.

He warned that if RBA didn’t give homeowners what they deserve, they need to take matters into their own hands and give themselves the biggest rate cut they could find.

“Someone with an average loan of around $600,000 would have seen their monthly repayments rise from $2,218 to $3,694 as the cash rate increased to 4.35 per cent between May 2022 – November 2023,” he said.

“That’s $1,477 a month – around $17,700 in extra repayments over a year.”

MORE: 7 banks slash rates as RBA showdown looms large

Shock as lenders slash rates to lowest level in 2 years

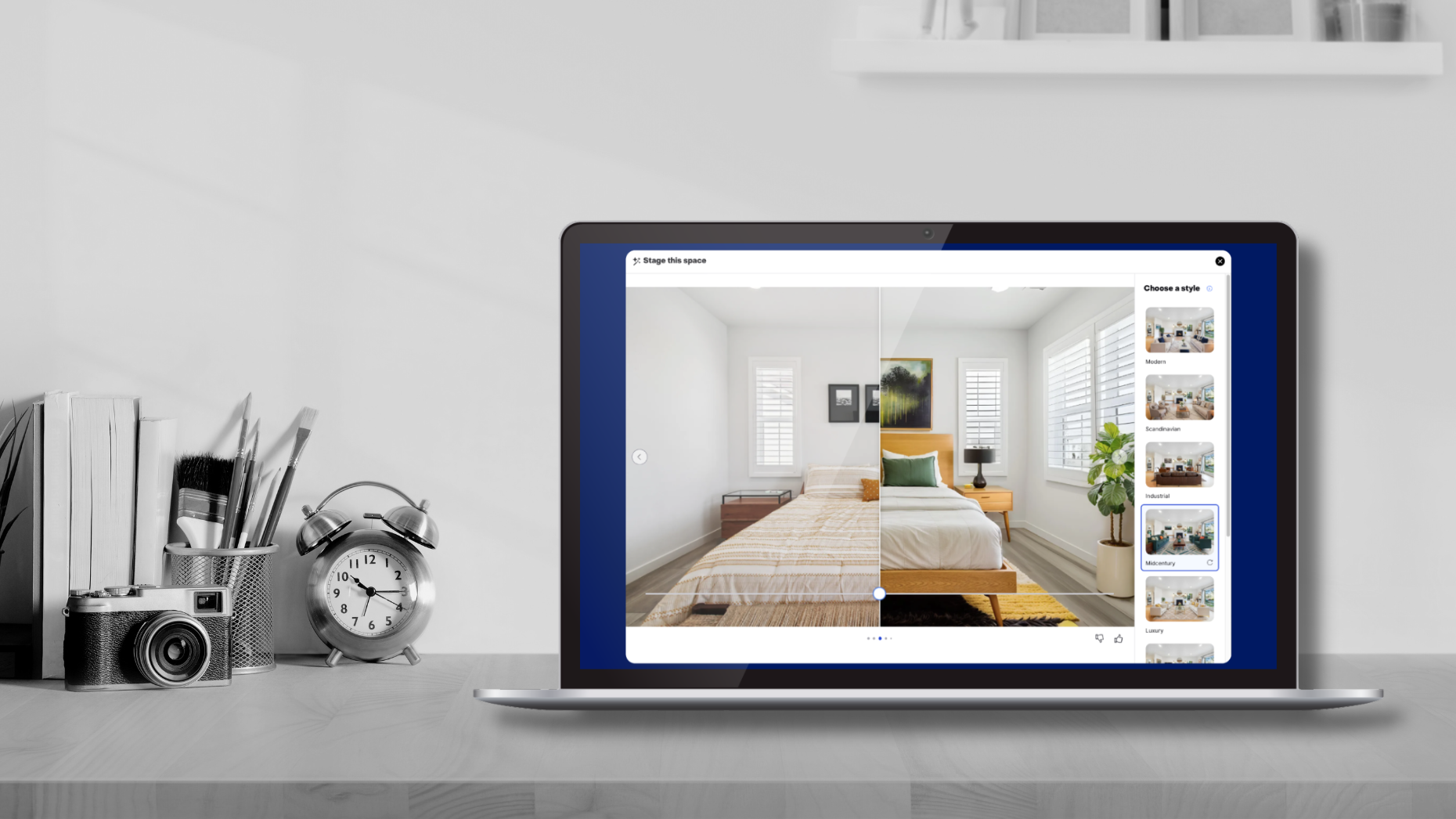

Compare the Market analysis of rate cut impacts. Source: Compare the Market.

Mr Koch said “young homeowners paying off a mortgage have carried the nation through the cost-of-living crisis”.

“They’ve had the worst of everything – higher prices at the supermarket, higher rates at the bank, plus the cost of everything from insurance to council rates going up.”

“And of course, they had to spend much more to purchase a home in the first place.”

“It’s thanks to their efforts that inflation is back in the Reserve Bank’s target range. They’ve tightened their belts, cut back on spending, and reckon it’s time some of that pressure came off.”

MORE: All the tax write offs Aussies can claim

ATO’s dragnet: Millions of side hustles face shock tax bill

Mr Koch said homeowners should take matters into their own hands if RBA didn’t deliver. Picture: Jono Searle.

He said “we can’t rely on the Reserve Bank or backs and lenders to deliver mortgage relief”.

“That means we have to be more vigilant ourselves to make sure we’re getting a good deal.”

He said Compare the Market’s database found a 0.50 percentage point difference between advertised rates from big banks.

“You can effectively create a rate cut of your own,” he said. “If you haven’t refinanced in a few years, it might be time to take a look and see if you can save with a lower rate.”

“If you’ve paid down your loan, and your home has increased in value, you might be able to achieve an even bigger discount.”

English (US) ·

English (US) ·