It can take weeks or even months before finally finding the perfect home. Then comes one of the hardest parts of the homebuying process: how much should you offer on a house—and should that offer be above, below, or at list price?

Take the following factors into consideration with your real estate agent, and you’ll have a better understanding of not only how much to offer on a house, but whether that offer makes sense for your market and situation.

1. Are you in a buyer’s or seller’s market?

Before you get your heart set on a property, it’s crucial to understand whether your area is currently a buyer’s market or seller’s market. That can be the determining factor in how much negotiating power you have.

- A buyer’s market is when there are more homes for sale than buyers. This can give buyers the advantage and extra leverage, especially if the seller is motivated.

- A seller’s market is when there are more buyers than homes for sale. Sellers have the upper hand in deals and homes can sell quickly and above list price.

Key takeaway: Market conditions influence not just price, but also which terms sellers prioritize. In a competitive market, sellers could prefer offers that feel more certain (like strong financing, fewer contingencies, flexible timing), even if another offer is slightly higher.

2. How much are comparable sales going for in the area?

“Comps,” short for comparables, are recently sold homes similar to the house you’re considering. Sellers use comps to help set an asking price, and buyers can also use comps to decide how much to offer.

You can browse comps on real estate listing sites like Redfin, but your real estate agent can provide a more complete view of market value by pulling data directly from the multiple listing service (MLS), including sold prices, concessions, and details that don’t always appear publicly.

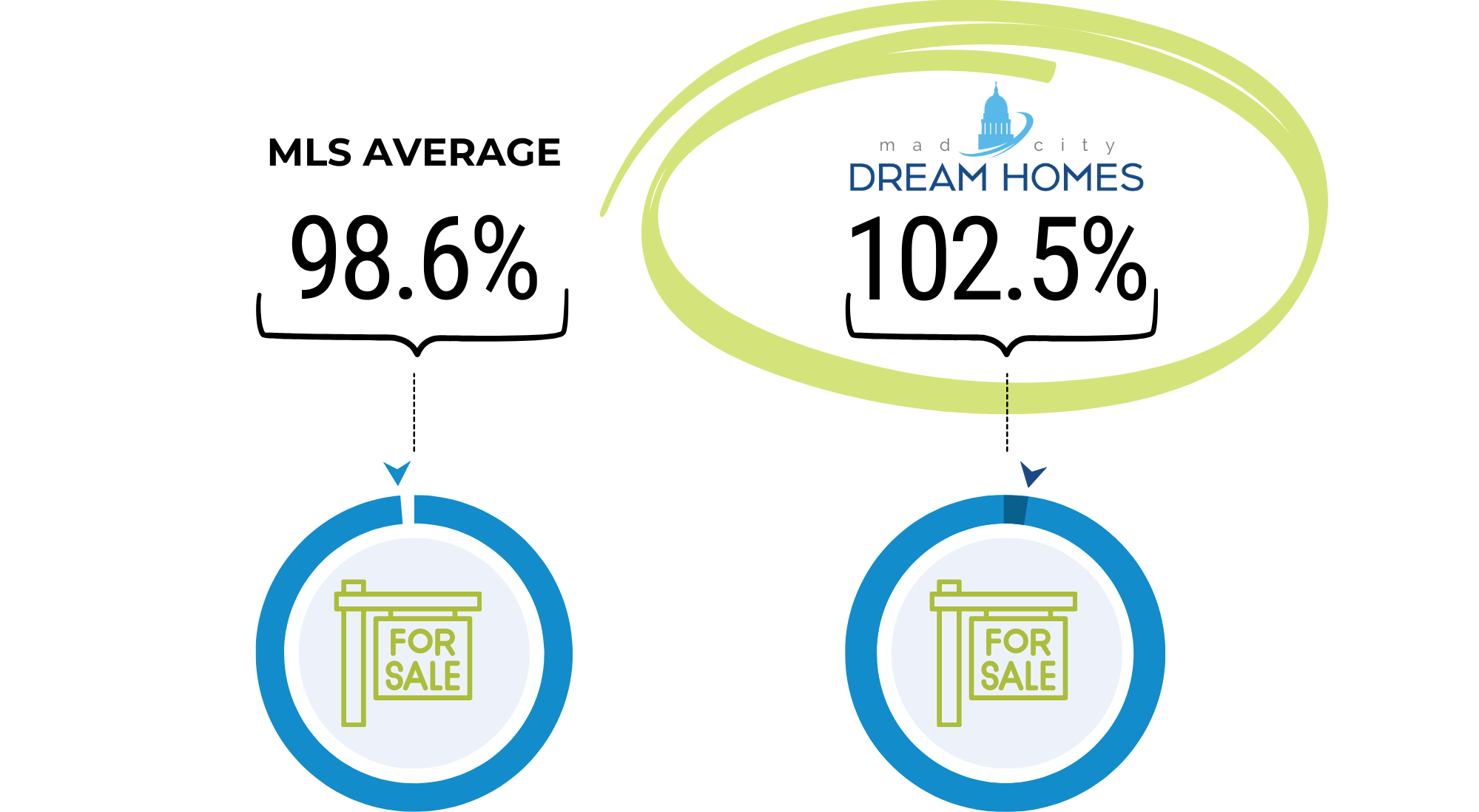

Add this to your comps process: sale-to-list price percentage

Comps tell you what homes are worth, but sale-to-list price percentage shows how homes are actually closing relative to asking prices in your market.

- If homes are typically selling below list price in your neighborhood, buyers often have more room to negotiate.

- If homes are selling at list price, pricing is usually tight and well-supported.

- If homes are selling above list price, you might need a stronger offer package.

Tip: To find the sale-to-list percentage for your area, search the city or zip code on Redfin’s housing market page to see what percentage of homes are selling above, at, or below list price. On any Redfin listing page, you can also find “market trends” at the bottom that will give you the sale-to-list number.

3. What’s the condition of the home listed for sale?

When looking at a potential house to buy, you can compare the home’s condition to recent comps. If similar homes were sold at a certain price but have recent repairs or updated finishes—and the home you’re considering needs work or upgrades — that can justify offering less.

Look at the:

- Condition of major systems (like the roof, HVAC, electrical, plumbing)

- Age of appliances

- Any obvious deferred maintenance

- Renovation and update level compared to comps

Basically, condition gaps between the home and comps can translate into price reductions and/or repair credits during negotiation.

4. What are the seller’s intentions?

Understanding why a seller is listing their home can give you an edge. Some sellers are relocating for a job and might take a lower offer if it means closing quickly. Others may have plenty of time and prioritize a higher price. Check with your real estate agent to see if they have any insight into the seller’s intent, such as:

- Timeline pressure (job relocation, or a home purchase already in progress)

- Preference for leaseback or flexible move-out

- Sensitivity to inspection and repair requests

Oftentimes, seller motivation can shape what a “good offer” looks like. Sometimes terms (like closing speed, flexibility, or fewer demands) matter as much as price.

5. What are your reasons for buying a house?

Your buying motivation and timeline influences how aggressive you should be in your offer. Are you a first-time homebuyer, buying for the next 10 years, or is this a shorter-term move? Being clear in your vision helps you avoid overbidding for a home that may not completely fit your goals and needs.

Key point: A good offer is one you can live with, both financially and emotionally, even if you’re not the highest bidder.

6. What’s your budget?

If you’re serious about buying, get pre-approved before house hunting begins. That means you have a lender available to work with you and know how much you’re able to spend. Pre-approval not only improves your credibility with sellers, it also helps you understand what you can offer.

That said, just because you’re approved for a certain amount doesn’t mean you should spend it. Run the full monthly-payment math (including taxes, insurance, HOA, and PMI if applicable), and leave room in the budget for any needed repairs, unexpected expenses, and closing costs.

To help determine a budget for your offer strategy, use a mortgage payment calculator, understand your maximum comfortable monthly payment, and set a firm spending ceiling before you negotiate.

7. What is a good offer on a house?

Once you’ve gone over what’s happening in the local market, comparable properties, the home’s condition, the seller’s motivation, and your budget, it’s time to make an offer.

A good offer reflects how homes are actually selling in your area and takes the entire offer package into account, not just price. While a lot of buyers focus on how much under or over asking to go, sellers are usually considering the entirety of the offer package, like:

- Price relative to list and comps

- Certainty (cash vs financing, strength of approval)

- Contingencies (inspection, appraisal, financing)

- Timing (closing date, possession, flexibility)

When it makes sense to offer less than the listing price

Offering below list price can make sense when the home is overpriced compared to similar properties in the area, if key components need to be replaced, or there aren’t a lot of offers already.

But keep in mind that while offering below asking price might be reasonable, an offer significantly below asking needs to have a clear explanation and data to back it up. Otherwise, a lowball offer can offend a seller to the point of choosing not to counter or negotiate.

You may have more flexibility to offer below list price when:

- The home needs major repairs or updates

- You’re in a buyer’s market with more inventory

- The seller is motivated by timing over price

- The home has been on the market longer than average

- The price has already been reduced

If local comps are closing below list price, a below-list offer that’s supported by the data can still be considered a good offer, especially if combined with clean conditions and financing.

When it makes sense to offer the listing price on a house

Offering at list price can be a strong move when a home is priced accurately and you want to be competitive, especially if it’s a home you love.

List price may make sense when:

- The home is move-in ready and well-maintained

- Comparable homes are selling close to list price

- The home is fresh on the market

Tip: If you’re stretching your budget a bit on price, you can strengthen an asking price offer with non-price terms (flexible closing, strong pre-approval, or reasonable contingencies).

When it makes sense to offer more than the listing price on a house

Offering above a home’s list price isn’t what most buyers want, but might be necessary when the home is exactly what you’re looking for and the competition is strong, or if housing inventory is low—meaning sellers can often take their pick of offers.

Before putting in an offer above asking, know your top dollar you’re willing to pay, while also taking into account closing costs, fees, moving, and any other expenses. That way, if a bidding war ensues, you’ll have a clear number to help you know if it’s worth continuing to fight for the home, or search for the next one.

Putting in an offer above-list price might be reasonable if:

- You’re in a seller’s market and there’s likely to be multiple offers

- Comparable homes are also going for above list price

- You’re serious about the home and willing to pay more for the right fit (location, layout, etc)

Important caveat: Offering above list increases the risk of an appraisal gap. If the home doesn’t appraise at your offer price, meaning the bank will only loan you what they think the home is worth, you may need to bring extra cash, renegotiate, or walk away (depending on your appraisal contingency).

8. What makes a good offer besides price?

When putting in an offer, price matters—but a lot of times sellers consider the offer terms as well. Sellers are often looking for offers that reduce uncertainty that the sale will go through, and that the process will be as smooth as possible. For buyers, this means working with your agent to come up with strategies to present your best offer—aside from price.

Financing strength

Sellers often prefer buyers with strong financing, like full mortgage pre-approval or a larger down payment, because it lowers the risk that the sale will fall through due to financing.

Contingencies

Contingencies are put in place to protect buyers, but ensuring less wiggle room to back out or more flexible conditions can make an offer more appealing for sellers. Common contingencies include:

- Inspection contingency: Protects you if problems are found during the home inspection. Buyers can sometimes keep the inspection “information only” and limit repair demands (or shorten the inspection window) to stay competitive.

- Appraisal contingency: Protects you if the home appraises below offer price. In competitive markets, buyers ready to negotiate or bring more money to the table can consider an appraisal-gap strategy.

- Financing contingency: Protects you if your loan falls through.

Timing and flexibility

An offer that matches the seller’s preferred closing timeline, or allows flexibility for move-out or when you get the keys, can be just as valuable as a higher price. Keeping communication clear and limiting last-minute changes where possible is key here.

Earnest money deposit

A larger earnest money deposit can let the seller know you’re serious and reassure them that you’re committed to closing on the home. If you back out of the sale for a reason not listed in the purchase agreement, the seller keeps the earnest money to account for lost time on the market, reducing their overall risk when accepting your offer.

At the end of the day, a good offer on a home is a balance of protecting yourself as a buyer and remaining competitive. In a lot of situations, you can improve your offer without removing protections altogether. Shortening timelines for a quicker close, clarifying your repair approach, or making your terms more seller-friendly can all help strengthen an offer.

Bottom line

Your offer should reflect:

- Whether you’re in a buyer’s or seller’s market

- What comparable homes are actually selling for

- The home’s condition

- The seller’s motivation

- Your reasons for buying

- Your budget

Take these six factors into consideration, and you and your real estate agent can determine your offer strategy. Remember, a “good” offer isn’t always the highest price, but also what’s considered competitive for your area and attractive to the seller without pushing you beyond your comfort level.

FAQs

Is 10% off a lowball offer?

As a general rule, the closer homes are selling to list price, the more cautious buyers should be with large discounts. If homes in your area are selling close to asking price, 10% off can feel aggressive unless the home needs a lot of work or has been sitting on the market. In slower markets, or when the price is clearly high compared to similar homes, a 10% lower offer may be a reasonable place to start the conversation.

What is considered a reasonable offer on a house?

A reasonable offer is one that reflects what is happening in the local market and sale-to-list trends, while also fitting your budget and the home’s condition. In markets where homes are typically selling below list, a below-list offer could be reasonable. In markets where homes are selling at or above list, a reasonable offer may be at or above asking and paired with strong contract terms.

English (US) ·

English (US) ·