Holidaying homeowners are leaving open the door to extensive property damage by failing to do basic checks around the house before they leave, new insurance claims research shows.

And it’s got long-time host of TV show The Block Scott Cam fired up, with the professional carpenter telling The Daily Telegraph that most damage could easily be prevented.

“A lot of time it would only take 10 minutes to have a look,” he said, referencing the type of damage revealed in the insurance research.

“The stats on the kind of damage you can get while your home is vacant are staggering.”

Allianz claims data showed that January to March is the busiest time of year for Home and Landlord insurance claims, with the damage usually occurring while residents were away.

The damage was often the result of a lack of maintenance – basic checks that could be performed, in most cases, by homeowners without tradie qualifications.

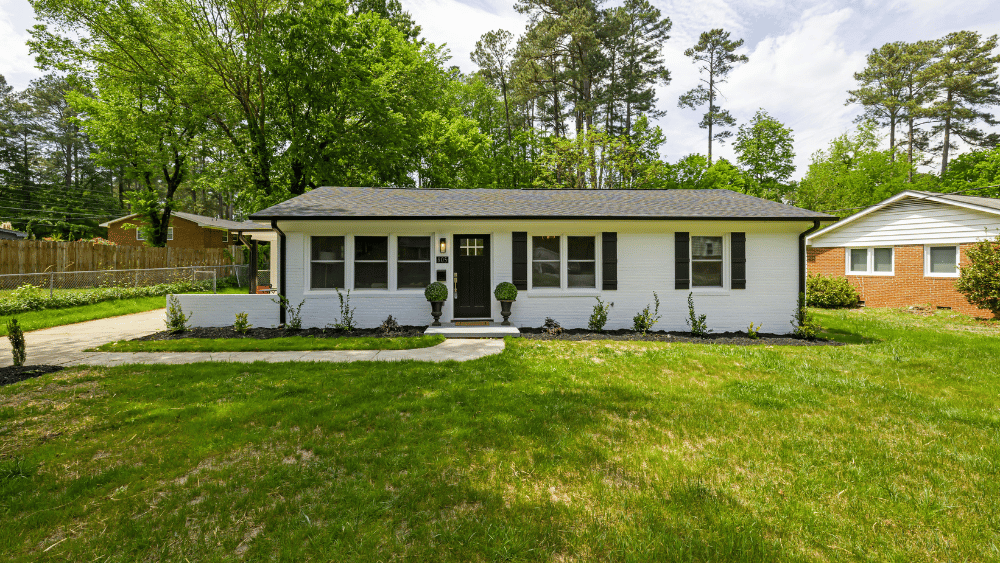

Scott Cam is urging Aussies to check their homes before going on holiday.

MORE: Stretch of road billed as ‘dream home’ in bizarre sale

Failing to do regular home maintenance increased the risk of something breaking, with the number of claims relating to escape of water up 10 per cent in 2024.

One in three Aussies polled in Allianz research said they did not regularly check for signs of wear, leaks or weak spots in their waterproofing and flexi hoses in bathrooms, laundries and kitchens.

Mr Cam, who has hosted The Block for 15 seasons, said failing to check a flexi hose could be particularly costly as the hoses could easily break, flooding much of the house. The hoses usually connect toilets, among other things, to the home’s water supply.

“There was $19m in claims from failed flexi hoses in 2023. That’s something people can check. You can get on hands and knees and check.

MORE: Where Aussies could face LA-style fire insurance disaster

Claims as a result of damage caused by faulty flexi hoses were substantial last year.

“Checking for vermin is also a very simple thing to do. I had it happen to me once, where a rat chewed on a fridge pipe that led to the water outflow … (it) flooded the kitchen.”

One in three Aussies polled in additional insurance research indicated they were not aware that the same accident in a vacant home could be substantially pricier to fix than in one occupied.

A similar proportion of Aussies said they only did home maintenance when something broke or needed urgent attention.

The research also found that about two thirds of Aussie homeowners skimped on maintenance knowing it could devalue their home or cause their insurance claims to not be paid out in full.

Allianz Australia has teamed up with Mr Cam to share tips on maintaining your home.

MORE: What really happens to home values during floods, bushfires

Scott Cam said he once had a kitchen leak occur while he was away from his home.

“Summer means trips to the beach, quality time with loved ones and some extra free time. Using some of this extra free time to do some home maintenance can save you time and heartache in the future.

“Taking small steps, such as checking waterproofing and flexi hoses, trimming trees, checking gutters or changing exhaust fans can help prevent incidents and ensure you can have a worry-free summer break,” Mr Cam said.

Shez Ford, Chief General Manager, Consumer, Allianz Australia said it was normal for household-related matters to get overlooked.

“From our research, it’s good to see that Aussies understand the importance of home maintenance but just need some guidance on how to get started.

“The research also highlights that half of Australians who have Home or Contents Insurance do not review their policy before the summer months.”

TIPS: THINGS TO DO BEFORE LEAVING

> Turn off water and unplug appliances

> Turn off the main water supply to prevent burst pipes

> If you have a flexihose, inspect it for any signs of wear, leaks, or weak spots

> Unplug unnecessary devices

> Use, freeze, or dispose of items that may spoil while you’re away

> Ask a neighbour or friend to check your home regularly

> Make sure all doors and windows are securely locked

> Hide valuables or invest in a home safe

> Keep up with regular home maintenance: This helps to future-proof your property, avoid problems, and to make sure your insurance coverage remains valid

> Review your home and contents insurance to make sure you’re covered

English (US) ·

English (US) ·