Zillow made waves last week after issuing a surprising revision to their housing market forecast: They now expect national home prices to decline over the next 12 months. That’s a notable shift—and it’s got a lot of investors asking questions. Is Zillow overreacting? Are other experts on the same page? And more importantly, if a buyer’s market really is forming, is that actually bad news for real estate investors? Let’s break it all down.

From Modest Growth to a Predicted Decline

If you’ve been following Zillow’s monthly forecasts, you’ve probably noticed a steady trend downward. Back in January, they were predicting a modest 3% increase in home prices through early 2025. By February, that number dropped to 1.1%. In March, just 0.8%. And now? Zillow’s latest model is calling for a -1.9% price decline between March 2025 and March 2026. Now, to be clear, this isn’t a doomsday prediction. A 2% drop in home prices is a correction, not a crash. But it is significant, especially coming from a company that’s been relatively optimistic in the past.

What’s Causing the Downturn?

So what’s behind the shift? It comes down to two basic fundamentals: more supply and still-weak demand. New listings are up 15–20% year-over-year, which is good news for inventory-starved markets, but it puts pressure on prices. Meanwhile, affordability is still tight. Mortgage rates have bounced back to the high 6s or even 7%, and that’s keeping a lot of buyers on the sidelines. Zillow’s not calling for a crash, just a continuation of the slow-cooling trend we’ve seen over the past several quarters. And, as always, national numbers don’t tell the full story.

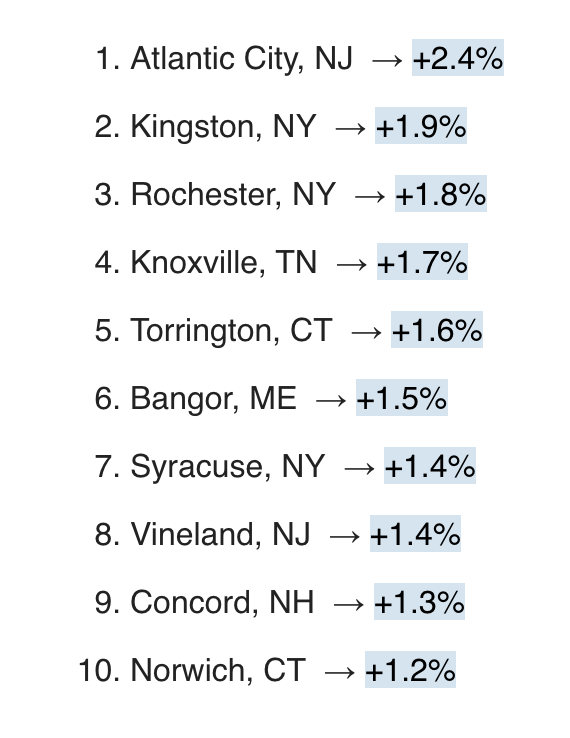

Zillow’s city-level forecasts paint a more nuanced picture. The Northeast is still expected to see price growth, modest but positive.

ResiClub’s Analysis of Zillow’s Report

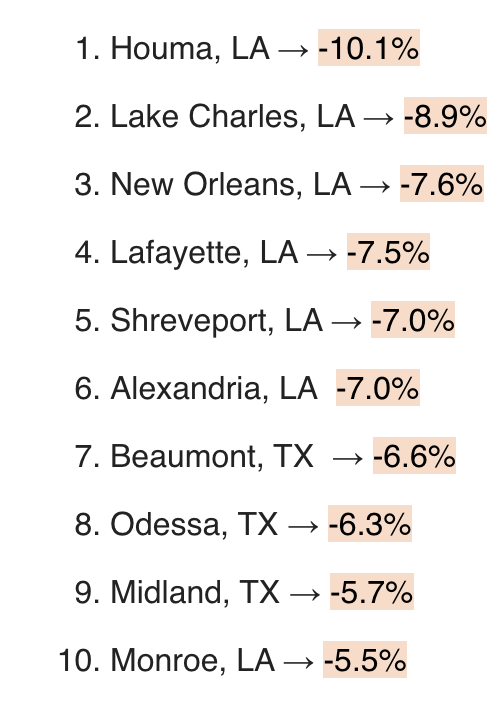

ResiClub’s Analysis of Zillow’s ReportThe Gulf Coast, parts of Texas, and Northern California could see steeper declines.

ResiClub’s Analysis of Zillow’s Report

ResiClub’s Analysis of Zillow’s ReportMost of the country is flat—somewhere in the -2% to +2% range. In other words, this is pretty much what I predicted late last year: A mixed bag of flat markets with a few hotter and colder pockets.

Are Other Forecasts Saying the Same Thing?

Now, let’s zoom out. Zillow is just one forecast among many. Fannie Mae still projects +1.7% growth. Wells Fargo is a bit more optimistic, expecting +3% growth via the Case-Shiller index. J.P. Morgan is also in that 2–3% range. So, while Zillow’s -1.9% prediction stands out, most other forecasters still believe prices will rise modestly. That said, Zillow’s bearish call does carry weight, especially since many assume their models tend to skew bullish to begin with.

Personally? I think Zillow’s call is reasonable. In fact, I’ve said for months that most markets will be broadly flat—somewhere in the -3% to +3% range. So, a -1.9% national forecast doesn’t strike me as alarmist. It fits the trend. And honestly, the trend is what matters. You don’t need perfect precision to make sound investing decisions—you need directional clarity. And right now, that direction is clear: softening conditions. Inventory is rising. Demand is fragile. Uncertainty is high. Those are facts.

Where we go from here depends almost entirely on macro conditions. If inflation cools and interest rates stabilize? We might see a return to modest price growth. If rates stay high and economic uncertainty drags on? Modest declines—like what Zillow is predicting—are totally possible. But here’s the most important thing: No one credible is forecasting a crash. There’s just not enough distress in the system. Yes, a recession is possible. But a crash requires forced selling on a wide scale—and there’s no evidence that’s happening.

So…are price declines even bad? Depends on who you ask. For sellers? Not great. For flippers and BRRRR investors? Tricky. For those obsessing over the paper value of their portfolio? Sure, it can sting. But for long-term investors? A buyer’s market could be exactly what you’ve been waiting for. This isn’t 2021. The market isn’t hot. But that creates opportunities. Motivated sellers. Negotiation leverage. Less competition. Maybe even a discount.

My Strategy Moving Forward

I’m personally looking for deals where I can buy 2–4% below market value. That cushions me against downside risk and sets me up to hold a valuable, income-producing asset for the long haul. As always, I look for properties with rent growth potential, zoning or regulatory upside, value-add opportunities, or location in a path of progress. If I can check 2–3 of those boxes, I’m buying. Even if prices dip a little more. Because I’m investing for the next 10–20 years—not the next 10 months.

Yeah—price declines might sound scary. They always do. But if you zoom out and think strategically, this could be the start of a more favorable investing environment. Flat-to-down markets aren’t the enemy. They’re the setup.

Analyze Deals in Seconds

No more spreadsheets. BiggerDeals shows you nationwide listings with built-in cash flow, cap rate, and return metrics—so you can spot deals that pencil out in seconds.

English (US) ·

English (US) ·