We often hear the phrase, “I’m taking out a loan.” But in reality, you’re buying a loan. It costs money, and there are countless lending professionals looking to sell you their products.

Your mortgage loan officer will play a key role in helping you secure the financing you need to close your home purchase. But who pays the bill for their services? How do loan officers get paid?

In this post, we clarify the who, how, and when of the process. We’ll also share tips to save money and provide a list of questions to ask to ensure you know who’s handling one of the largest loans you’ll ever purchase.

Find a Top Buyer’s Agent to Guide You

HomeLight can connect you with a top real estate agent familiar with the mortgage application process and home listings in your area. We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs.

What is a loan officer?

A loan officer is a financial professional employed by a bank, credit union, or other lending institution. Their primary role is to help you find and apply for a mortgage that suits your financial situation. Loan officers guide you through the application process, assess your eligibility, and present loan options that match your needs.

A true loan officer who is not a mortgage broker is usually limited to only offering the loan products their employer provides. Consumers outside the industry may use the term “loan officer” to refer to someone who actually authorizes the loan, but mortgage approvals are usually handled by the underwriter.

What is a mortgage broker?

A mortgage broker serves as an intermediary between you and multiple lenders. Unlike a loan officer who works for one financial institution, a mortgage broker has access to a broader range of loan products from various lenders.

Their job is to shop around on your behalf, comparing loan options to find the best terms and rates for your specific circumstances. They don’t lend money directly but instead connect you with lenders who do. You might compare a broker to a distributor who sells fruit that another company grows.

What is a mortgage lender?

A mortgage lender is a financial institution or entity that provides funds for your home loan. Lenders can be banks, credit unions, or specialized mortgage companies. They are responsible for underwriting your loan, meaning they assess your creditworthiness and decide whether to approve your loan application.

The lender is the source of the money you borrow, and you’ll make your mortgage payments directly to them. While loan officers and mortgage brokers help you navigate the process, the lender is the one who ultimately provides the loan. A mortgage lender might be compared to the farm that produces the fruit.

Mortgage lenders own the loan: If you’ve had a mortgage in the past, you may have received notice that your loan management was transferred to another company. They have the right to sell the servicing rights for a profit, which includes selling on a secondary market to government-sponsored private mortgage companies like Fannie Mae, Ginnie Mae, or Freddie Mac.

The key difference between the definitions we’ve provided is that a mortgage broker is an independent entity. Brokers have the freedom to work with a variety of different mortgage lenders. In contrast, a true loan officer typically works directly with their mortgage lender employer.

How do loan officers get paid?

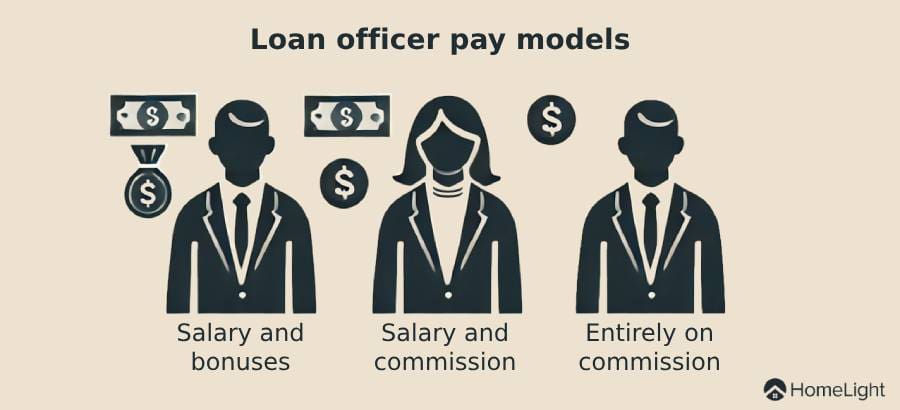

A loan officer who is not a broker will usually earn their income through a combination of salary and bonuses. How your loan representative is paid will depend on who they work for and whether they are a broker or a direct employee of a mortgage lender. The different pay models can look like this:

- Salary and bonuses (or incentives)

- Salary and commission

- Entirely on commission

For loan professionals who work on commission, the size of the commission is often based on how the lending company was introduced to the borrower. If a mortgage company provides the lead, the percentage of the commission is typically smaller. If the loan officer found the lead the percentage of the commission is often larger.

Pay is earned: Mortgage loan officers work diligently to market their services, much like real estate agents who strive to find homebuyers and sellers to represent. These industry professionals rely on networking, a reputation or trust, and a track record of satisfied customers and favorable results.

Loan officer commission example

Let’s look at an example of a mortgage broker working from a 1% commission structure. On a $500,000 loan, the brokerage office receives a $5,000 commission.

The loan officer will receive a negotiated percentage of that $5,000 commission. If their share is 80%, the loan officer will receive $4,000. However, this range can vary from 20% to 80%, depending on the commission agreement and the level of involvement the loan officer had in the transaction. With a 20% arrangement, they may receive as little as $800.

Loan officer salary + bonus example

Now let’s look at an example of a loan officer who is paid a base salary and a small bonus. This might be a loan officer who works for a large, nationally known bank.

If the loan officer completes a mortgage loan for $500,000, and the bank they work for offers a bonus based on the loan amount, they might receive a bonus of $1,500. A smaller loan of $200,000 might earn the loan officer a $600 bonus.

Bonuses and commissions are often calculated using basis points (BPS), units of measurement that assess percentages in financial instruments, including interest rates. One basis point is equivalent to 1/100 of a percent. In our first bonus example above, 30 bps of $500,000.00 equals $1,500.

How much do loan officers make?

Because there are a variety of ways your loan representative can get paid, and because the “loan officer” job title is not always defined the same on salary tracking websites, the annual compensation estimates cover a wide range. For example, ZipRecruiter reports a range of $23,000 to $135,000 per year and cites an average of $79,825, or about $38 an hour. But Indeed places a loan officer’s annual salary at $183,022, and GlassDoor lists a median salary of $194,290 per year.

The disparity in these salary estimates is likely because of variables such as commissions, cash bonuses, and profit sharing.

When is a mortgage loan officer paid?

Mortgage loan officers can be paid at the beginning or the end of the borrowing process. Within the industry, this is referred to as “on the front” or “on the back” of the loan.

On the front (borrower-paid compensation): This is when the borrower is charged fees, such as a settlement fee, and that money is given to the loan officer. The borrower might pay these fees with their own money or have them rolled into the loan.

On the back: (lender-paid compensation): This is when the lender funding the loan pays the commission. If the commission is paid by the lender rather than the borrower, the compensation will not show up on your closing documents. Loan officers who get paid on the back end of a transaction may market their services with a phrase like “no out-of-pocket fees.”

Regulations abound: The lending industry and the fees you pay are highly regulated. Federal Regulation Z of the 2010 Dodd-Frank Act requires mortgage providers to provide borrowers with written disclosure of important credit terms, such as how much their loan will cost. In addition, a loan officer can either be paid by the lender or the borrower, but not both.

How does the lending company make money?

No matter which path it takes, the money paid to your mortgage loan officer will come from the lender’s profits. The lender’s profits come from:

- Loan origination fees

- Income from interest charged

- Income from servicing the mortgage

- Proceeds earned from a secondary mortgage market sale

A quick (and free) way to check your home value

Get a preliminary home value estimate in as little as two minutes. Our tool uses information from multiple sources to give you a range of value based on current market trends.

Questions to ask when shopping for a mortgage loan

When you’re shopping for a mortgage loan, asking the right questions can help you find the best option for your needs. Here’s a list of essential questions to ask:

- What are the total costs associated with this loan?

- Can I get a quote without a hard inquiry (hard pull) against my credit?

- If I find a better loan quote, will you match it?

- How are you, as a loan officer, compensated?

- Are there any upfront fees or hidden charges?

- What is the interest rate, and is it fixed or adjustable?

- How much will my monthly payments be, including taxes and insurance?

- Are there any prepayment penalties?

- How long will it take to close the loan?

- What are the requirements for down payment and credit score?

- Will your company actually fund my loan at closing?

- Will your company be servicing my loan after closing?

Tips to save money on a mortgage loan

Saving money on a mortgage loan is possible with a few strategic moves. Here are some tips to help you reduce costs:

- Shop around and compare offers from multiple lenders.

- Improve your credit score before applying for a loan.

- Make a larger down payment to reduce the loan amount.

- Consider a shorter loan term to save on interest.

- Avoid unnecessary fees and ask for fee waivers.

- Refinance your mortgage when interest rates drop.

- Lock in your interest rate to protect against future increases.

- Pay extra toward your principal whenever possible.

Find a mortgage provider that works for you

Choosing the right mortgage can be just as crucial as finding the right house. The right provider can offer favorable terms, competitive rates, and exceptional service that aligns with your financial goals.

If you’re ready to start, HomeLight’s Agent Match platform can connect you with top-rated real estate agents in your selected market who can help guide you to the best mortgage providers and the best homes to fit your needs.

If you’re buying and selling a home at the same time, check out HomeLight’s modern Buy Before You Sell program, which provides a streamlined, simplified, and more certain process to make your best move. See this short video to learn more.

Header Image Source: (Amy Hirschi / Unsplash)

English (US) ·

English (US) ·