Buying a home isn’t just about having a place to live; it’s one of the most reliable ways to build long-term wealth. While renting can offer flexibility, owning a home lets you build equity, benefit from potential appreciation, and access valuable tax advantages. Over the years, increasing equity and financial stability can turn your home into a valuable long-term asset.

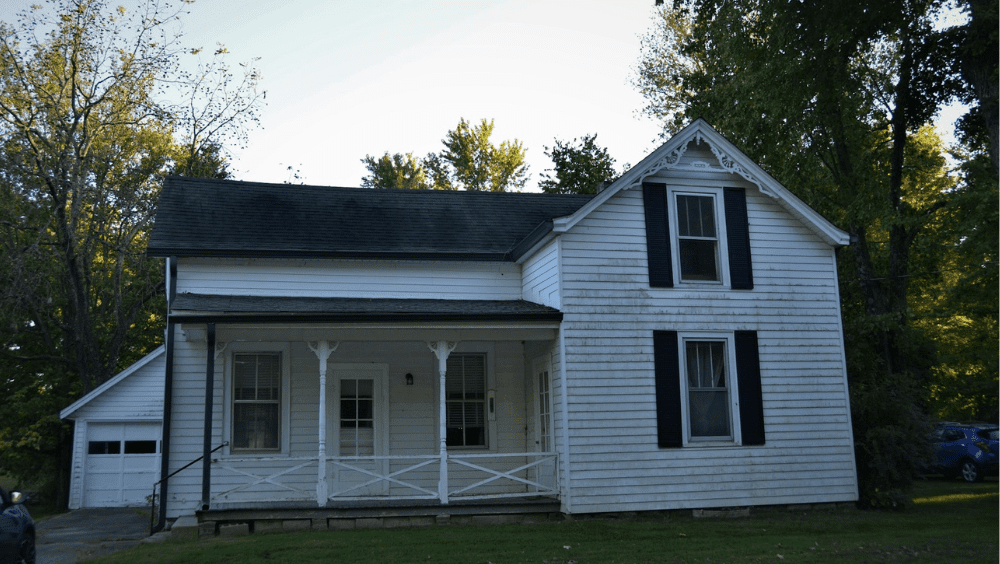

In this Redfin article, we’ll cover how buying a house can help you build wealth and how to make the most of your investment. Whether you’re buying a home in Detroit, MI, or a townhouse in Denver, CO, here’s what to know about building home equity through homeownership.

Key takeaways

- Buying a home can build wealth through home equity, tax benefits, and more.

- Your home may appreciate over time, helping you build wealth when you sell.

- Buying a home you can afford, maintaining it, and making improvements can help protect your investment.

4 ways owning a home helps build wealth

There are several ways that buying a home can help build wealth over time. Here are four of the main ways homeownership can achieve those benefits.

1. Home equity

One of the most well-known ways that homeownership helps build wealth is through home equity. Home equity is the percentage of the home you have paid off. For example, if you put 20% down, you’d own 20% of the home. As you pay off more of your mortgage, you’ll build more home equity.

That growing equity can serve as a powerful financial tool. You can access it later by selling your home, refinancing, or borrowing against it for major expenses. For example:

- A home equity loan uses your equity as collateral, allowing you to borrow from yourself. You borrow a lump sum of cash, which you can use for various expenses like home improvements, investing, or paying off debt. These loans typically have lower interest rates than personal loans.

- HELOC is a line of credit that lets you borrow as needed from your home equity. The line of credit is open for a set number of years, and you can borrow money as needed. You will need to repay what you borrowed, and interest rates are typically variable.

2. Tax benefits

Owning a home means there are tax benefits available each year, some of which you may qualify for. Four of those deductions include:

- Mortgage interest tax deduction: This is the biggest ongoing tax benefit for homeowners. For those who itemize their taxes, you can deduct interest paid on your mortgage up to the IRS limits.

- Property tax deduction: You may be able to deduct state and local property taxes paid on your primary residence (up to $10,000, $5,000 if married filing separately).

- Home equity loan deduction: If you have a home equity loan, you may be able to deduct interest on the loan if you’re using it for home improvements.

- Capital gains exclusion: If you decide to sell your home, you can exclude up to $250,000 ($500,000 if married filing jointly) in profit from capital gains tax.

These benefits vary by individual, so consult a tax professional to understand which apply to you.

3. Potential for home appreciation

Home appreciation is another way that owning a home can help you build wealth. Homes are typically considered an appreciating asset, meaning their value likely increases over time. This makes it a more reliable way to build generational wealth, especially if you plan to pass on your home to heirs.

For example, if your home’s value rises a little bit each year, that growth compounds over time. Combined with paying down your mortgage, you could have a significant profit when you sell. Regular maintenance and home improvements can also help your property appreciate faster.

4. Passing down your home

As mentioned above, owning a home allows you to build generational wealth by passing the home down to heirs. When someone inherits a home, they benefit from a stepped-up tax basis. This means the home’s cost basis is adjusted to the current market value. When selling an inherited home, heirs will likely pay capital gains on any additional profits that exceed the home’s current market value.

For example, you buy a home for $400,000 and it increases in value to $500,000 by the time it’s inherited. The inheritors sell the home for $525,000. With the stepped-up tax basis, they would only pay capital gains tax on $25,000.

How to make your home purchase worth it

Building wealth through real estate doesn’t happen automatically. It takes smart choices and consistent maintenance. Here are key steps to make the most of your investment.

Buy a home you can truly afford

The first step to making homeownership worth it is buying a house you can truly afford. If you’re stretching your budget each month to pay for your mortgage, it may not leave you with enough for additional expenses, investing, and an emergency fund. You can use a home affordability calculator to estimate how much you can afford or a mortgage calculator to get an idea of your mortgage payments.

When buying a home, it’s likely you’ll get a pre-approval. A mortgage pre-approval is an official letter from a lender certifying what loans you’re qualified for and how much you can borrow. A good tip is to buy a home that’s less expensive than what you’re pre-approved for. This can help keep you below budget and have room to increase your offer price if needed.

While high-interest rates shouldn’t deter you from buying a home if you’re financially ready, a lower interest rate can help save you money in the long run. The lower the interest rate, the lower your mortgage payments are over time, leaving you with additional income to invest.

As an example, you’re planning to buy a home that costs $500,000 with a 20% down payment.

| Interest rate | Mortgage payment | Loan term |

| 6.375% interest | $3,216 per month | 30-year fixed |

| 5.8% interest | $3,068 per month | 30-year fixed |

In this example, you’d save $148 per month or $1,776 per year. Over the lifetime of the loan, you may save up to $53,280.

Choose the right location

Your home’s location is one factor that you can’t change. It can influence how much your home appreciates over time and whether you decide to stay in the area for years to come. Think about the neighborhood or city you’re planning to live in. See whether it meets your lifestyle and needs.

Consider some of the following factors when choosing a location:

- Amenities, like shopping centers and restaurants

- Proximity to public transit

- Access to major roads and highways

- Nearby parks, trails, or outdoor spaces

- School districts

Talk to your real estate agent about neighborhood trends, including where home values have increased most over time.

Maintain your home

Keeping your home in great condition can help you protect your investment. Regular maintenance prevents costly issues and preserves your property’s value. Examples of seasonal maintenance include:

- Servicing your HVAC

- Clearing your roof and gutters of debris

- Checking your smoke and carbon monoxide detectors

- Pruning trees and clearing dead limbs

- Inspecting your plumbing for leaks or drips

Invest in high-ROI home improvements

Choosing the right home improvement project not only improves your day-to-day life but may also increase your home’s value over time. There are many home improvement projects to consider, and some have a higher return on investment (ROI) than others.

According to a 2025 report by Angi, the projects with the highest ROIs include garage door replacements (194% ROI), entry door replacements (188% ROI), new siding (153% ROI), and interior painting (107% ROI). Choosing the right home improvement projects for your home will vary depending on your wants, needs, and budget.

>>Read: 8 Home Improvement Projects That Add Value to a Home

Protect your investment

Maintaining your home is one way to protect it, but there are other things you can do. Home insurance, which lenders require, helps protect you and your home in case of damage, including some natural disasters. Depending on where you live, you may also want to consider specialized insurance plans such as fire or flood insurance.

Home warranty isn’t required, but it can help save you money if you have appliances that need repair. For example, a home warranty can cover electrical systems, major appliances like a refrigerator, and central heating.

Is owning a home the right way to build wealth for you?

Homeownership can be a great way to build wealth over the long term, through home equity, tax benefits, and more. Buying a home you can truly afford, maintaining it, and making worthwhile investments can protect your investment over time. Speaking with a real estate agent or financial advisor can help you understand the benefits of building wealth through homeownership.

English (US) ·

English (US) ·