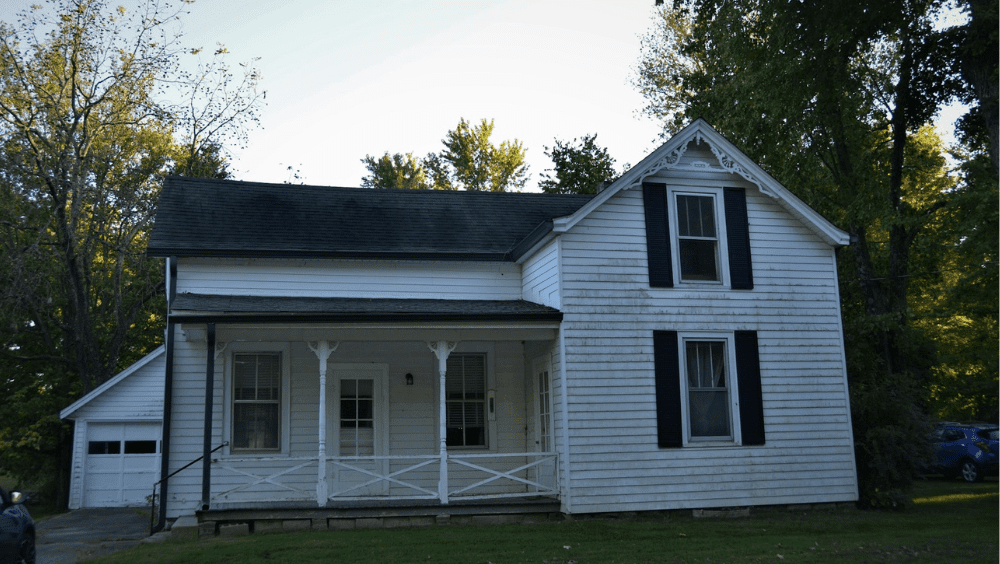

Many of us have heard about, or will soon learn, the now-infamous Baltimore story. One borrower bought multiple houses on the same block, rehabbing one unit and copying its photos to make the others look renovated on paper. He changed appraisal condition statements, submitted identical photos to multiple lenders and walked through a maze of loans that started as 12-month bridge products and morphed into 30-year Debt Service Coverage Ratio (DSCR) loans. The apparent fraud ballooned into roughly $200 million. He paid in the short term, enough to transition loans correctly. Then the defaults landed squarely in the DSCR world, where lenders must sort it out.

That story exposes the Achilles heel of modern valuation when people believe they can game images and PDFs rather than deal with actual properties. Virtual tours and Matterport models — a 3D digital twin of a physical space, created using Matterport’s technology — are helpful, but nothing replaces a trained appraiser walking through a property.

Boots on the ground matter. Phones still ring. A simple conversation with a borrower or the investor often prevents fraud nightmares. Yet, in too many loan processes, nobody speaks to the borrower, and they do so only by text. That convenience is precisely what fraudsters exploit.

AI’s double-edged sword

For every legitimate, efficiency-boosting advance, someone is building a weaponized version.

Voice cloning has already moved from a clever demo to a tool for wire fraud. There are documented cases where a voice nearly identical to a borrower or a manager convinced someone to reroute funds. That is not science fiction; it is a real loss vector that demands stronger verification protocols than a simple “it sounded like Joe.”

At the same time, AI is not the villain in every scene. It is also one of the best hopes for safeguarding the industry. The same pattern recognition and synthesis capabilities that produce convincing fake audio can also analyze thousands of appraisal reports and virtual tour captures in seconds. Processes that once seemed futuristic now enable merging multiple reports, extracting and comparing data, and flagging inconsistencies that would slip past manual review.

This is where the industry has to be aggressive, not timid. Appraisal management companies face a choice: remain the type of brokers that simply flip orders or build true capabilities. Only a handful have invested in the technology talent to develop scalable solutions. That matters because strong systems can help detect photo reuse, mismatched condition notes and geographic anomalies hinting at coordinated fraud.

Saying hello goes a long way

Human contact remains essential. A quick phone or video call can reveal credibility issues that no PDF will ever show. If a lender never speaks to a borrower, that practice needs to change. Private lenders especially need appraisal products designed for investor use cases and partners who understand them.

Proper inspection protocols are equally important. Virtual tools are excellent, but they must be paired with local expertise. Sending appraisers on site when needed, randomizing validations and adding a layer of local review for clustered acquisitions are all safeguards. When several houses on one block suddenly appear rehabbed, that should be treated as a red flag, not an opportunity to push loans faster.

AI: trap or safeguard?

Adopting AI should go in both directions: embrace it where it helps and defend against it where it harms. Machine learning can be used to run dual valuations, detect reused imagery and spot textual inconsistencies. At the same time, lenders must upgrade wire-transfer safeguards and multi-factor verification processes to protect against voice cloning and social engineering schemes. The single-check email authorization model is outdated.

Appraisal needs also differ by loan type, and that distinction is critical. An appraisal for a Fannie Mae loan is not the same as one for a debt service coverage ratio loan or a residential transition loan. Knowing those differences is not optional; it is risk management.

Market pressure adds fuel

Market realities cannot be ignored. If rates fall and demand spikes, affordability will worsen. More people will rent. Investors will supply those rental homes, and private lending will fuel that growth. More investors mean more loans and more opportunities for fraud.

The future should include better data, smarter cross-checks and products designed for investor realities. It should also feature virtual tours that improve both speed and verification and AMCs that invest in technology rather than just pass through orders.

It should also include a healthy dose of skepticism. When a shiny new technology promises miracles, ask the awkward questions. Who built it? Who tests it? Who benefits when it fails? If a process can be gamed by swapping a few images or cloning a voice, it needs to change.

Moving faster than fraud

Fraud will evolve. That is inevitable. The better question is whether the industry will evolve faster. The tools and talent are already here. The challenge is to use them in ways that do more than cut costs, to use them to protect the capital and the people who depend on sensible valuations.

The practical takeaway is simple: build relationships, invest in technology with real safeguards, keep appraisers on the ground when needed, and when someone offers a paper trail that looks too good to be true, pick up the phone. It will save time, money and regret.

Mike Tedesco is Vice President of Private Lending at Class Valuation.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners. To contact the editor responsible for this piece: [email protected].

English (US) ·

English (US) ·