After hearing this episode, you’ll have no excuse not to reach financial freedom in under a decade. Today’s guest did it in even less time, scaling up to income-replacing cash flow in just a matter of years, even with a very demanding full-time job and constantly moving around the country. Through pure hustle, Taylor Wing is now financially independent in his late twenties with a sizable rental property portfolio that spits out cash flow to pay for his South Florida lifestyle. He’s got so many tricks to reach financial freedom faster, but his best piece of advice? The number of rentals you own doesn’t matter.

Taylor was a full-time military member, serving in the Army for the first five years of his career, bouncing between North Carolina, South Dakota, and beyond. Wherever he was stationed, he began buying houses as soon as possible. That meant Taylor spent almost every hour of the day working, either at his job or on his rental property portfolio, for years straight. Was it a grind? Yes. Was it worth it? 100%.

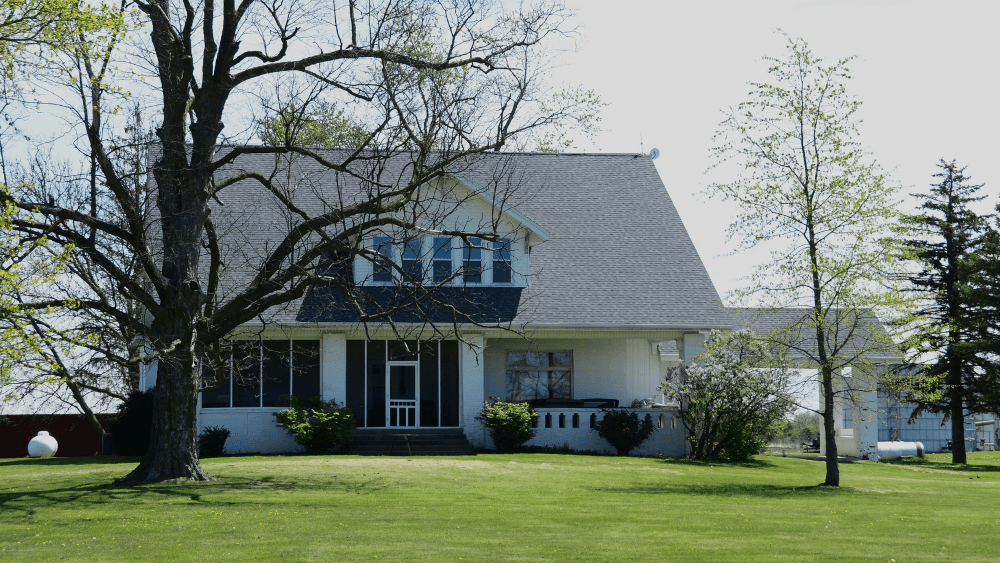

Now, fast forward seven years after graduating from West Point, and his family is financially free. He has his beautiful house on the water in Florida and is spending more time with his new (and growing!) family. Through “rebalancing” his rental portfolio, strategically using “reverse 1031 exchanges,” and other savvy strategies, Taylor is now in complete control of his time. He’s teaching you how to do the same today!

Dave:

This investor started with a single house hack. Three years later, he had more than 30 rental properties and was able to transition out of his demanding military career and into the life he always envisioned for his family. Now he’s acquiring multiple new properties per year, but he spends most of his time leaning into what he calls the Florida lifestyle. This isn’t some secret formula that you can’t execute. It’s the result of following a reliable, sustainable path to invest. Let’s hear how it works. What’s up everyone? I’m Dave Meyer. I’ve been buying rental properties for 15 years, and on this podcast we teach you how to achieve financial freedom through real estate investing. Today’s guest is investor Taylor Wing. Taylor started his investing career when he was an active duty army officer looking for the financial security that would allow him to leave the military when his service commitment was up.

He started with just a single house hack and was able to grow his portfolio to more than 30 units across three different markets in just three years. That real estate investing has allowed him now to prioritize his family’s lifestyle, live where he wanted, and to find a new career that’s fulfilling for him at this stage of life. Taylor shared some of his story a few years back on this podcast on episode 6 77, but I wanted to have him back on the show because a lot has changed in his investing since then. He still has around 30 units, but many of those properties have turned over as he’s looked to simplify his investing so he can spend more time with his growing family. He’s still trading out and finding and acquiring great new properties every year, but he’s found ways to do it with much less pavement pounding than before. These are really important skills that every investor needs to learn, whether you’re just starting your real estate journey or you’re in the harvesting phase like Taylor is. Let’s bring ’em on. Taylor, welcome back to the BiggerPockets podcast. Thanks for being here.

Taylor:

Good morning Dave, and thanks for having me back.

Dave:

Yeah, this is going to be a lot of fun. I hope that a lot of you have heard Taylor’s first episode. It was 6 77 back in October of 2022, but for those who haven’t yet listened to that one, Taylor, maybe give us a little bit background about yourself, how you got into real estate in the first place.

Taylor:

Yeah, so just sort of quick Cliff notes on me. Again, born and raised in California pretty much straight out of high school. Went to the academy up at West Point, was an army guy commissioned, graduated in 2018, decided to be an artillery man. Went to airborne school, did the paratrooper thing, and then after about five and a half years exited service. So last time I was on this podcast, I was still in the army actually, and real estate was my side hustle and we were in a heavy acquisitions mode. Didn’t have any kids back then either. So I devoted all of my spare time to real estate and now where we are today is a complete 180. So lifestyle has changed a ton. Of course, we transitioned out of the military, started our family and doing real estate.

Dave:

Great, man. Well, congrats. It sounds like you’ve made a lot of progress. I’m curious, going to West Point, were you originally thinking of having a career in the military?

Taylor:

Yeah, that was of course the original game plan going into the academy, trying to make it up the ranks as far as I could. But while I was in the service, I read, of course everyone, rich Dad, poor Dad, got super heavy into real estate. I found some real estate mentors too and started flipping houses, doing burrs, doing creative financing, some wholesaling, and just kind of fell in love with real estate and real estate changed my life. So I’m super grateful. I found BiggerPockets and I found my mentors. It changed the trajectory of my life. So instead of doing a career in the military, of course we did a big pivot.

Dave:

Well, that’s amazing. Well, thank you for your service, but I totally understand whether it’s military, corporate life, whatever. A lot of people read that book, rich Dad, poor Dad,

Taylor:

Get

Dave:

The bug and move into it, but it sounds like you found something you really like. We’re going to get to what Taylor’s been doing now, but I just want to catch everyone up to what he was doing in the beginning. So what was it like investing while you were still in the military? What kind of deals were you looking for at that point?

Taylor:

Yeah, so in the military we did pretty much any acquisition strategy you can think of. I did house hacking with VA loans, FHA loans, a lot of low down payment options as a government employee. Didn’t make a ton of money back then. I was brand new Butter bar second lieutenant. We made decent money but not enough to just start buying houses. I was probably buying maybe one a month at that point

Dave:

You were buying one a

Taylor:

Month, how a lot of low down payment options like sub two seller finance burr strategy using hard money loans with trying to cash out refinance on the backend. And of course VA loans are a super powerful tool for all my veterans out there where you can buy a property, zero down, living it for a while, and then you can either flip it on the backend and pull that equity back out and get it into your next VA loan or you can hold onto it and keep renting it. I still have my very first VA loan locked in at 2.7% interest and

Dave:

Never give it up.

Taylor:

Now I have so much equity is built up after COVID, but the interest rate is so great. I don’t know if I ever want to sell that. So

Dave:

When you were doing this, were you just buying where you were stationed at the time or did you pick one hub that you wanted to be investing in?

Taylor:

So I actually invested where I was stationed, so I was stationed in Fort Bragg, Fayetteville, North Carolina. So

Dave:

It

Taylor:

Was a great rental market and I love military markets. So I started investing exactly where I was and I was real grassroots with it. I was door knocking, I was cold calling, I was boots on the ground. I didn’t have much money for a marketing budget, so I was really hustling. My five to nine was really out there getting after it.

Dave:

I bet, yeah. And so were you renting mostly to other folks in the military?

Taylor:

A combination pretty much right off the bat. I hired a professional management company. It was just too much for me to keep on fronting the acquisitions, doing the management and still being in the army. So I pretty much hired a professional property management right at the gate. But definitely a lot of military families for sure, and my kind of niche in that market has always been single family homes, three bedroom, two bath typically, or if not more bedrooms. So it’s perfect for your typical family is kind of what I always like to cater to over there.

Dave:

How long were you doing that when you were actually still in the military building up this portfolio? Pretty aggressively?

Taylor:

Yeah, very aggressively. Really hustling for probably a good four years.

Dave:

Oh wow,

Taylor:

Okay. While I was in the service and I had a service obligation, so I kind of set a self goal that was like, can I make enough cash flow from this portfolio to match my government paycheck, to give me that flexibility to transition out if I wanted to once my commitment was up. So that was kind of my challenge I had set for myself back then.

Dave:

And how close were you able to get while you were still in the service?

Taylor:

She made a little bit more from the passive than I was making from my paycheck, so luckily it timed out perfectly to where maybe like a half a year after my service obligation, I hit that number and that kind of gave us that green light to look at our options outside of military service. At that point, my wife and I were looking to settle down, start a family and everything too. So the timing really worked out perfectly and those years of sacrifice did end up paying off for us.

Dave:

Okay. So that was sort of just some background. You were on the show back in October of 2022. What year time did you actually transition out of the military?

Taylor:

I transitioned out summer of 2023.

Dave:

Okay, so a little bit later. And did you just keep doing the same kind of real estate approach at that point?

Taylor:

No, at that point I did shift and it was partially just because of our lifestyle and also because the market, if you remember around that time, oh, I remember interest rates more than doubled. It got crazy. We got burned a little bit on some flips that were kind of sitting out there. I had a lot of money out there. And so really after once I transitioned out I was still doing real estate, but I didn’t really quite have a game plan. I got out and the same month I had my son.

Dave:

Oh wow.

Taylor:

So I moved to Florida, got the army all the same month down here in south Florida. So I pretty much went straight into dad mode and the real estate gave us more flexibility to give me that time to spend my wife and the newborn.

Dave:

Well, congratulations on your family. That must’ve been very exciting. How did you pick another market?

Taylor:

For me, I always invested where I lived. I like to touch and I like to feel like to be involved and that might not be the best option for everybody out there, especially in high cost of living areas. But I went from Fort Bragg, I moved to Sioux Falls, South Dakota, so I bought a good handful of property out there and then now we moved down here to Florida and I’ve been buying stuff around here as well. So I’ve always invested where I lived. When you went

Dave:

From North Carolina to Sioux Falls, what was different about that market and how do you adapt?

Taylor:

So interesting enough, the property values in South Dakota were actually higher than they were in North Carolina. So the numbers for long-term back then were not super sexy and we found it interesting niche because my wife was travel nursing back then and Sioux Falls has two large hospitals which kind of service almost the whole state right there in the central region of the city. So we kind of focused on that. There was a lot of travel nurse contracts and that my wife was also being a part of. So we started buying small mom pop multifamily within a certain radius around these hospitals and then we kind of really tailored to that travel nurse midterm rental strategy. So Fort Bragg, we catered to military family, single family homes, Sioux Falls, really kind of more smaller apartment mom and pop catering to more of the travel nurses over there.

Dave:

Was that a big change operationally for you going from doing more of the midterm rental style thing? It

Taylor:

Was. That’s when I got my wife more involved in real estate, whether she liked it or not. I finally got her on board before it was just me doing it all and she kind of let me do my thing. But really once I got her involved in the travel nurse side, kind of more hospitality based a little bit, and she was a travel nurse so she knows what travel nurses want and what they need. So she really helped me and I brought her into the business on that way.

Dave:

Cool. Thank you for setting the stage for us, Taylor, and giving us a little bit of background. I want to shift the conversation, talk about when you moved to South Florida, what did your portfolio look like and what you’ve been up to in the last couple of years. But we do need to take one quick break. We’ll be right back. Everyone. Just a reminder, if you are listening to this in the next couple of days, Henry Washington and I are doing our Cashflow Roadshow, so definitely follow along for all the content that we’re going to be making. But if you are in the Chicago area, we have a free meetup on July 15th. And if you’re in the Indianapolis area, we have a free meetup on July 16th. Make sure to RSVP because you got to do that before you come, you can go to biggerpockets.com/roadshow to do just that. Welcome back to the BiggerPockets podcast. I’m here with investor Taylor Wing. Before the break, he was catching us up on his portfolio, how he got started buying while he was still in the military in North Carolina and then in South Dakota. Taylor, you said then it was sort of a shift in your life where you were going from being in the military to starting a family, being out of service. You moved to South Florida at that point. What did your portfolio look like

Taylor:

Back then? It was very similar to how it is now. Actually. We had roughly around 35 units. We’re still around that number now, but what we really focused on now is life optimization and cashflow a little bit before I would’ve been more focused on number of doors, all these other arbitrary numbers that I was tracking, but really it came down to just cashflow and lifestyle once we had a family because we wanted to make as much money as possible with the least amount of effort possible. I love that. Yes. Don’t we all? I don’t care about doors anymore really. The other metrics, even equity, I know I appreciate and it helped in appreciation, but cashflow is king right now.

Dave:

So what

Taylor:

We did was we kind of strategized, we looked at our portfolio, we really dove into the numbers, which I didn’t really do before, and we were trying to see, all right, which ones are really working, which ones are not, which ones are our performers and not. And we just started moving money around, did some 10 31 exchanges, got some better properties, and so we’re at the same unit count, but I think we’ve implemented systems to make it run a lot better so we can maximize that passive cashflow that’s ultimately helping us pay our bills and helping us live our lifestyle.

Dave:

Everything you just said we need to dive into because I think this is a really big topic for investors right now. A lot of people have fortunately built up some equity built up a portfolio during the runup in all these prices, they have a lot of equity and I get this question all the time, how are you rebalancing? How are you thinking about curating? So let’s talk about that. But first you just mentioned that cashflow is your goal. You had previously said though that you had already replaced your income from the military, which is awesome. What was your new goal and how did you set it? Do you have a specific cashflow number you’re trying to get to or is it just maximize it indefinitely?

Taylor:

For me, it’s honestly just maximizing it indefinitely. And I did suffer from lifestyle creep because once I got down here, I wanted to live the Florida lifestyle.

Dave:

You buy a boat,

Taylor:

Not a boat yet, but that’s in the works, but got the biggest house I possibly could. I’m on the water down here on the Intercoastal, how

Dave:

Sick.

Taylor:

We built a pool and everything and did a bunch of upgrades. So we know we’re really living the Florida lifestyle, but really just trying to maximize that number as much as we can. But I would say that we hit that level where I feel like we have a foundational level of financial freedom where we feel comfortable paying our base level expenses. And so whenever we go out to work, we’re just basically helping build that portfolio and saving towards whatever we want to do next with our lives, whether it’s vacations or college funds, really anything, it’s just helping us get to that next level because eventually we want to be at a level where we’re that just we’re paying all of our basic expenses to, we’re growing and we’re really thriving.

Dave:

That’s awesome. A very noble goal. I’m sure a lot of people relate to this that yeah, real estate, great way to make money, but it is a means to an end. It’s like money in itself doesn’t buy you happiness, but it can buy you flexibility, which is a great way to get happier in my opinion. So I love that. But let’s dig into this idea here of rebalancing your portfolio. This is super important stuff right now you have this great portfolio. You said you hadn’t been really looking at the numbers. What were you doing just acquiring great assets and not really thinking about efficiency or what did you need to change?

Taylor:

I was so focused on acquisitions. I would never pass up on a deal. So I was buying properties as fast as I could get as many houses under my belt as I possibly could. I mean, I would do a general cashflow, but once you’ve been operating a property for at least a year, you can really look back at your expenses and how much you’ve been spending on the property versus how much income it’s generating and just really look down your proformas and make those decisions. So it’s just something I didn’t slow down before and really look at to optimize. And then once I slowed everything down and I was able to just look at the numbers and go, okay, it makes more sense. We have a ton of equity here, why not move it into maybe some properties that’ll perform a little better for us and help us make more

Dave:

Cashflow. Can I ask how you logistically did that? Do you have spreadsheets or what was the actual process like for doing this? Because I think a lot of investors find themselves in a similar situation that you were in where it’s like you buy the deal, you see the cash on cash return that you’re projecting, but then they don’t actually go back and say like, am I actually hitting that return? Or even if I’m hitting that return, is it as good as all the other deals that I’m buying or all the other deals I could go get on the open market today? What were the actual tools you used to pull this off?

Taylor:

For one, we always had QuickBooks, but I’d never really looked at it. But what we did was we actually took some classes in QuickBooks to really learn how to use the programming.

Dave:

Oh, smart.

Taylor:

And we also hired a great CPA and a great accountant that changed the game for me. Before I was just paying tax bills and I had no idea why it was that number or how we got there,

But now I found somebody that we have strategy calls and we tried to project what our tax liability is going to be and we get ahead of it. So then we start game planning. So when it comes tax season, we’re ready for it. So CPA changed my life, a good accountant that sat with us and helped us clean up our books and helped us be able to pull the reports we need per property to really look at and see, okay, which ones are working for us, which ones are not performing as well. So I think those guys are really important to help you get to that next level. I don’t think you need to invest a ton of money, maybe upfront you’re just getting your first couple properties, but once you have a sizable portfolio, those guys are going to save you so much money and they’re going to help you make those executive decisions.

Dave:

Absolutely. That’s a great way to do it. I think this is probably one of the most underrated things that investors should be doing. I try and do this personally quarterly. I just take not sometimes I am not that good about it, but at least annually I should say. I try and do it quarterly, but just update what’s going on in your portfolio. And I built this spreadsheet. It’s actually part of my book. If anyone has read start with strategy, you will be able to download this or maybe you’ve seen this, but I created the spreadsheet that after you get that information, either from your accountant or if you do it yourself, a way to just sort of side by side, look at every property that you have. And I personally like to look at it as a bunch of different levels. Your equity that you got in it, cash on cash return is of course important.

Cashflow. I like to do two things that I think are super important that a lot of people miss is one is risk. Like how risky is this property? I want to see, are all my properties super risky? That’s a problem. Are all my properties super low risk? That’s also a problem I probably missing out on some upside. And the last one I do is how much time each property takes me because there’s always a pain in the butt property. And when you look at these things side by side, you’re like, oh, that pain in the butt property is actually making me the least amount of money. Why don’t I sell this thing? This thing sucks. Or you’re like, oh, this one is just amazing. I’m always going to hold onto that. So I really, whatever tool you use, recommend people do this for yourself. So Taylor, when you started doing this, what jumped out to you? What did you learn?

Taylor:

Yeah, what I learned, like you said, there’s some properties that are just a thorn in your side that are just taking way too much time and attention away from you and costing you way too much money. I had a property, it was a cheaper one. One of the ones I first bought the problem with, it was just not a good neighborhood and just problem after problem, it was just like, get somebody in there, they destroy it, turning it over, that’s 15 grand again. Oh, we got squatters kept breaking in. I gave the property plenty of chances. It was one of the first ones I bought to make it work. But after two or three iterations of this and going through maybe two or three different management companies,

Dave:

I love the idea of giving the property a chance. It’s the property fall, but it is kind of true. It’s like some properties just they struggle and you just got to get rid of ’em and that’s okay.

Taylor:

Yeah, it takes someone with maybe a more peculiar set of skills than I had, or maybe that was able to deal with a lot more stress than I was able to deal with. So to me, it wasn’t worth it. That was one of the ones I liquidated and just move that money somewhere else. It wasn’t worth the headache for me. I have a whole thing I got going on with my life and I didn’t want to just be a property manager. So

Dave:

Was that hard? Because there is this narrative in the real estate investing community, it’s like never sell. I just buy and just never sell. Was it hard to sort of shift your mindset?

Taylor:

I used to be like that. Maybe you’re taking a step back, right? I worked so hard to get this property and now I’m selling it and you’re paying an agent, probably you’re paying closing costs, it kind of sucks. But after you see how much heartache you went through and you look over your statements and you see how much money that you’ve sunk into this thing, just rip the bandaid off, man. Yeah, I

Dave:

Totally agree.

I think it’s a hard thing because it’s a new skillset to learn. You were mentioning you were sort of just in acquisition mode. That’s a skill that usually, and I think rightfully, people learn first. That’s kind of what you need to do. But portfolio management, totally different skill and learning how to optimize your resources, optimize your time. That’s where I think most investors get to. You get to that point, but you do is a little daunting to learn how to manage that. I would love to hear how you have gone about managing that and how you’ve transformed your portfolio. We have to take one more quick break though. We’ll be right back. Managing rentals shouldn’t be stressful. That’s why landlords love rent ready. You can get rent in your account in just two days, which means faster cashflow and less waiting. Do you need to message a tenant chat instantly in app with no more lost emails or texts. Plus you could schedule maintenance repairs with just a few tabs, which means no more phone tag. Are you ready to simplify your rentals? Get six months of rent ready for just $1 using promo code BP 2025. Sign up using the link in the buyout because the best landlords are using rent ready.

Welcome back to the BiggerPockets podcast here with Investor Taylor Wing. Before the break we were talking about how Taylor had started to transform his portfolio. So Taylor, you did this analysis, great work, figuring out properties that were working for you weren’t working for you. How did you go about repositioning your resources and assets into new properties?

Taylor:

First of all, it took a lot of retooling for me. Like you said, it’s a completely different skillset for me and my personality. I would much rather be on the acquisition side or on the sales side, chit-chatting with people out in the field, talking to contractors, making things happen. That’s the kind of guy I am. So sitting behind a computer and having to crunch numbers and look at reports and it’s just not as fun for me. So what I love

Dave:

That

Taylor:

Stuff. Yeah, I’m not a very analytical person. It took a little bit of retooling, but what really forced me to do that is we we’re looking at how much rents we’re pulling in versus the debt service and we’re like, why aren’t our numbers better than we should be making a lot more money than what we are? Where’s this money actually going? That’s what forced us to really look into this and make those decisions.

Dave:

And when you did that, so let’s just say you pick a property not performing, did you automatically sell all of them? Did you consider refinancing any of them or how do you think about that?

Taylor:

Yeah, a couple options. Like you said, maybe it’s like, oh, should we switch? Maybe try a short term or a midterm or should we do a cash net refinance, roll that equity in some other properties. But really for me, once I figured out how to do a 10 31 exchange, that’s what really made the most sense. I was able to get that kind of maybe headache property off of my plate and I was able to move that money into properties that will actually get us towards that financial freedom number that we’re chasing. So for me, a 10 31 made total sense. I was able to defer the capital gains on that. So it’s a powerful tool. I love the 10 31. If anyone hasn’t done one yet, definitely look into it. It’s not super expensive. I can’t remember how much it cost me. Maybe like a thousand or 2000, something like that, and was able to save maybe close to six figures in taxes alone.

Dave:

Yeah, it’s 20% of the equity that you built

Taylor:

Up. It’s

Dave:

Crazy. It’s a lot.

Taylor:

So it’s a powerful tool and definitely need to use it.

Dave:

Yeah, absolutely. And if you’re not familiar what a 10 31 is, it’s a part of the tax code that allows specifically real estate investors. This is a really unique part about being a real estate investor. If you buy a property, it builds up all this equity, that’s great. But when you go to sell, if you wanted to trade out, like Taylor’s talking about without this rule, you pay 20% capital gains on your profit. So if you bought it for, I’ll use very simple numbers, you bought it for 200, sell it for 300, you have a hundred thousand dollars in profit there, you’d pay 20 grand in taxes, which again, you made a hundred grand. So that’s good. But ideally you want to take that a hundred grand and reinvest it into another property. It allows you to keep scaling and the 10 31 exchange allows you to make a tax free exchange into what they call a like for property.

So you take an investment property, you buy another one. There are some time limitations that make it a little bit stressful, at least in my experience, doing it a few times. But it could be very, very worth it. So if you were in this portfolio management stage of your investing career, checking out a 10 31 and using it can be a really, really powerful option. So Taylor, when you went about selling these properties, were you going to reinvest in the markets they were in now across three markets, right? You’re in North Carolina, you’re in South Dakota, you’re in South Florida. Did you just reinvest in the same market or did you want to bring everything to Florida to sort of consolidate?

Taylor:

Actually the opposite. I had properties in Florida and I moved that money out of the state back to Sioux Falls and Fayetteville. And the reason being is what was really prices that were creeping up was my insurance costs. My properties were cash flowing initially, and then with the rise of insurance costs, which is a problem in our state, it needs to be addressed. It just basically breaking even or even at a slight loss. So it didn’t really make sense for me to hold them anymore.

Dave:

And that’s kind of what I was curious about because you bought a lot of your properties in the early 2020s and it was easier, frankly, to find a lot of deals.

Taylor:

It was.

Dave:

So I’m curious, how relatively hard or easy was it to find cash flowing deals in the other two markets you operate in?

Taylor:

Much easier. I mean because the Midwest and in the Southeast it’s a lot easier to find cashflow. Just prices of real estate are just not as high as you would see down here in south Florida. Florida’s been appreciating like crazy, especially after COVID. Our market’s cooled down quite a bit, but we’re probably going to be competitive with California soon. I don’t know. We’ll see.

Dave:

I actually made a whole episode of on the market, our sister podcast about Florida and what’s happened there the last couple of years, from 2020 to 2023, I think prices went up 50%, which is just absolutely insane. Normally that would probably take two decades in a normal situation and nationally it went up like 40%, but it was 53%. So yeah, Florida has been, I think up until 2024, the fastest growing state for those three years since then. It’s now largely in a correction, but

Taylor:

It’s,

Dave:

It’s been a rollercoaster ride, but a lot of amazing appreciation. So when you went to these other markets though, is it on market kind of stabilized deals that you could buy cashflow or were you fixing them up, finding off market? How do you go about it?

Taylor:

I’ve purchased most of our portfolio off market, either direct to seller or utilizing connections, wholesalers to acquire deals. There’s been a couple deals I’ve bought on market, but it’s pretty rare. There’s just so much more competition. Our primary house, though, is a really creative deal, how I bought the house I’m living in now, and that was actually an on-market deal, and that’s a cool seller finance deal that we negotiated. But for the most part, most of our deals that are in our rental portfolio have been off market.

Dave:

Okay, cool. And was it hard to build up that deal flow or did you have it already from operating there?

Taylor:

Yeah, basically by the time we moved down here, we already had our teams, our systems connections all set up in the markets that we were previously operating in. So it’s easier for me to plug back in. Even to this day, that’s where I’m still hunting for deals, primarily is in those two markets. And so when I find something, when somebody sends me a deal, I’m able to execute on it.

Dave:

How would you describe the profile of your deal today? Maybe just walk us through a recent one. What are you buying it for? How much work are you doing for it, and what does the cashflow come out to be?

Taylor:

I bought two deals in Fayetteville last year. They’re very similar deals and prices have increased in that market as well. So these two deals I did, they’re both burr deals. They were both sourced from connections and wholesalers. And basically I’ve been buying ’em probably in the one forties range, maybe in the one thirties if I’m lucky. And on the back end I’m probably getting them appraised for the two 20 to two 40 range.

Dave:

Nice.

Taylor:

So I don’t really do huge rehabs. I like to do cosmetic in and out within a couple months. That’s kind of how I’ve done with those last two that I bought. And cashflow is probably like 300 bucks maybe if you’re a lucky 400.

Dave:

That’s pretty good though. So what does that come out to on a cash? On cash return? So 400 bucks a month, that’s four ish grand a year in cashflow per property.

Taylor:

And maybe 300 bucks isn’t life changing, but you stack those dominoes up and once you build up a portfolio and you set those units on autopilot with a property management company, I feel like your lifestyle and your flexibility really starts to change and you can feel that.

Dave:

Oh, absolutely. And the other thing that I think a lot of people miss out on is that $300 a month is usually tax free if you’re doing it right, tax wise. So that’s the equivalent of making $400 a month or even four 50 depending on your tax bracket. So it’s just another thing to remember is that a lot of times rental income can almost be treated as post tax income, which is incredible. So you got to make sure to think of it that way.

Taylor:

Yeah, rental income is the best income. So

Dave:

Yeah. So if you’re buying it one 40, how much cash are you putting into each of these deals total?

Taylor:

Usually on the back end I’ll do a cash out refi. And on these ones I’m not able to pull all of my money back out. But usually my goal is if I can leave 10 grand or less than there, I’m happy from the front end because usually I’ll do a hundred percent financing on the front end. So on the back backend, I might have to bring maybe like 10 K to close.

Dave:

Okay. So you have a total of 10 K into this deal and you’re making four KA year off of that?

Taylor:

Yes sir.

Dave:

So that’s just a casual 40% cash on cash return. That’s insane.

Taylor:

That’s why I like to do the burr method and buy low and put in that sweat equity fixing up the property because just cash on cash return is going to be so much greater.

Dave:

I think this goes to say one, a lot of people are saying our cashflow are dead. Clearly not a lot of people right now say the bur doesn’t work anymore. So what is your message to those folks?

Taylor:

I think it’s a lot harder nowadays, which is why I don’t buy one a month anymore. But they’re out there. You just have to be patient and you got to wait for those deals. But there’s those diamonds in the rough out there still. You got to find them.

Dave:

So how are you finding them now? Still off market, but it’s slowed down from one a month. What is your cadence right now?

Taylor:

Yeah, so last year I only did two in Fayetteville.

Dave:

Okay.

Taylor:

If you’re able to even buy, in my opinion, even one a year, you’re making that four momentum still. It’s still awesome. So again, I don’t even care about doors or anything like that, and I don’t compare my portfolio to anybody else’s. It’s not a competition. It’s just all about cashflow and the lifestyle that it’s going to create for you.

Dave:

A hundred percent. I couldn’t agree more with the philosophy. Door count is very silly. There are people I know with amazing door counts and terrible cash on cash return. And then there’s the opposite, right? There’s people with 6, 5, 6 paid off properties that are crushing. That’s all you need. Yeah, it’s totally different. I been thinking a lot more about just starting to pay off properties at this point in my career career I have

Taylor:

Too.

Dave:

Not just being in total acquisition mode. It’s great. It’s really comforting for some reason. It is. This has been great, Taylor. Thank you so much for sharing all this with us. Do you have any last advice for folks listening to this before we go?

Taylor:

Again, a lot of those other metrics don’t matter as much. It’s all about lifestyle and real estate. It’s a powerful tool. Use it to create the lifestyle that you want, hand it off to a property management company and enjoy the money life’s meant to be enjoyed. Spend it with your family, spend it with your loved ones, and think of real estate is just a powerful tool to help you get there.

Dave:

Well, thank you so much for joining us, Taylor. Really appreciate you joining us again on the BiggerPockets podcast.

Taylor:

Thank you, Dave. Thanks for having me. Everyone out there. Thank you for listening.

Dave:

Yeah, we’ll have to have you back again a third time, Taylor. Keep it up. It’ll be fun to track your progress.

Taylor:

Let me know.

Dave:

Thank you so much for listening to this episode of the BiggerPockets podcast. I’m Dave Meyer. See you in a couple of days.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

English (US) ·

English (US) ·