If you’re an investor who’s looked out-of-state (OOS) for cash flow, you’ve probably run across Memphis, Tennessee, at one point or another. I initially dismissed the entire market due to its crime statistics and population stagnation. But that assessment is quite unfair: Real estate is hyperlocal, and there are specific neighborhoods with very low crime and solid growth.

And home values in the Memphis metro area have increased by 44.12% over the last five years, according to Reventure.

Memphis, TN MSA Highlights

Here are some highlights about the Memphis market.

- Median price: $265,200

- Median rent: $1,600

- Rent-to-price ratio: 0.60%

- Unemployment rate: 4.5%

Single-family rental rates in Memphis grew by 6.1% in 2024. And economists “predict that home prices in Memphis will increase by 10.5%, which would be one of the highest percentage increases in the country,” according to the City of Memphis’s Annual Comprehensive Financial Report.

The metro also doesn’t appear to be adding anywhere near as much housing supply as its neighboring metros:

Don’t let the graph deceive you: While 4,205 units were permitted for construction in 2024, the metro has a total estimated unit count of 576,520, meaning only 0.73% of its total unit supply was permitted for construction. The national average is 1.09%. For reference, Nashville permitted 2.29% of its total units for new construction (that’s more than three times the amount of relative supply Memphis has permitted).

So why does this matter? Builders aren’t building here as much as they are on average across the nation. That means there’s no wave of supply currently being constructed (which would put downward pressure on prices and rents). This is generally a good thing for existing investors as long as they buy in a desirable neighborhood—which I’ll get into in a minute.

Next, let’s discuss Memphis’ job market.

The Memphis Job Market

First, the unemployment rate is on par with the United States average (4.2%). And Memphis remains one of the largest logistical hubs of America: Memphis International Airport is the second-largest cargo airport in the world (No. 1 is in Hong Kong).

The metro is also home to three Fortune 500 companies: FedEx, AutoZone, and International Paper (the largest paper company on Earth). Many big companies also have distribution facilities here, such as Nike and Williams-Sonoma.

The medical industry is also growing here. According to a new report by the Greater Memphis Economic Research Group, “Buoyed by its globally recognized hospitals and one of the nation’s most robust medical device manufacturing sectors, the healthcare and life science industry of Greater Memphis grew its economic output by 45.2% over the past decade despite pandemic-driven job loss.”

St. Jude Children’s Research Hospital also launched an $11.5 billion expansion to improve its research and clinical treatments.

Medical devices aren’t the only thing the Memphis metro is manufacturing. According to Ford Motor Company’s website:

“Ford plans to make the largest-ever U.S. investment in electric vehicles at one time by any automotive manufacturer and, together with its partner, SK Innovation, plans to invest $11.4 billion and create nearly 11,000 new jobs at the Tennessee and Kentucky mega-sites… An all-new $5.6 billion mega campus in Stanton, Tenn., called BlueOval City, will create approximately 6,000 new jobs and reimagine how vehicles and batteries are manufactured.”

The Memphis Suburbs

The suburbs of Memphis are safe, have great public schools, and also have affordable houses with great rent-to-price ratios. Let’s get into individual markets that might make great locations for OOS investors to purchase cash-flowing properties.

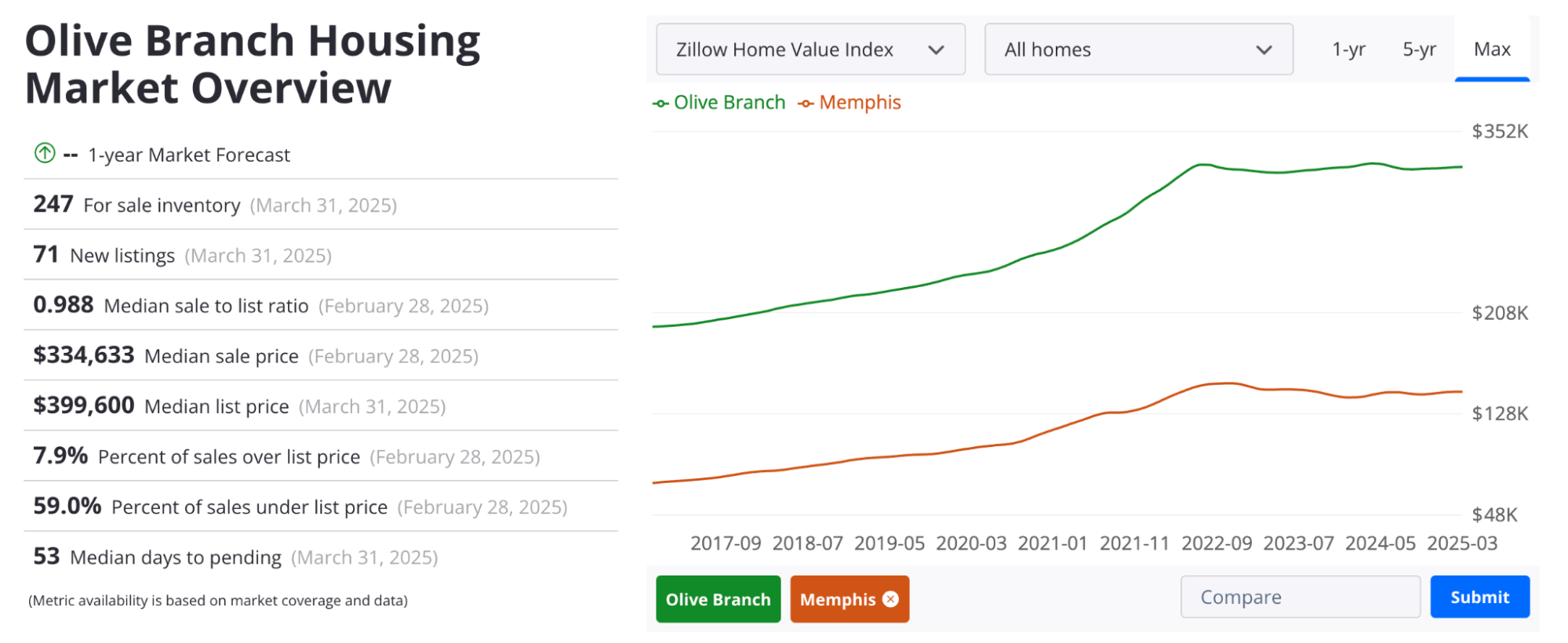

1. Olive Branch, Mississippi

Courtesy of Zillow

Courtesy of ZillowHomes in Olive Branch are priced higher than the city of Memphis ($335,000), but rent for an average of $2,000, according to Zillow. This gives Olive Branch a rent-to-price ratio of 0.60%.

The town, which is only 24 miles away from the heart of downtown Memphis, has also seen solid population growth over the past five years (an estimated 22.7% increase), certainly benefiting from people moving out of inner Memphis and into the suburbs.

Zillow also claims the current rental market is hot, meaning there is a lot of demand for rentals. This could be an excellent market for OOS investors.

2. Southaven, Mississippi

Courtesy of Zillow

Courtesy of ZillowThe median home price in Southaven is cheaper than Olive Branch ($271,000), and so is the average rent ($1,600). But this means the rent-to-price ratio is about the same (0.59%).

Southaven is the third-most populous city in Mississippi, and it’s the largest suburb of Memphis by population. Like Olive Branch, it’s also still growing.

3. Bartlett, Tennessee

Courtesy of Zillow

Courtesy of ZillowSimilar to Southaven, Bartlett is more affordable than Olive Branch with a median price of $308,000. But what’s more interesting is that, according to Zillow, the average rent is about $2,000, making Bartlett’s rent-to-price ratio the best of the three suburbs at 0.65%.

On the flip side, it actually lost 5.8% of its population over the same time period that Southaven and Olive Branch grew. While it might be easier to cash flow here, it may not appreciate as quickly as the other two suburbs due to population stagnation.

There is no such thing as a “free lunch” in real estate markets: Towns that have strong cash flow often don’t have as strong population growth. For this reason, it’s important to work with a boots-on-the-ground expert like an investor-friendly real estate agent and property manager to help you navigate local neighborhoods.

Or you could work with an end-to-end company that helps you find, acquire, and manage turnkey rental properties. One such company that specializes in the Memphis market is Memphis Investment Properties.

Want Help Acquiring Cash-Flowing Properties in Memphis?

Memphis Investment Properties offers a turnkey solution for investors seeking cash-flowing rental properties in Memphis. With a seasoned team handling everything from acquisition to property management, they make passive income truly hands-off. Their local expertise and commitment to quality ensure that investors can confidently build their real estate portfolios. If you’re curious whether they’re a good fit for you, click to learn more about their process.

English (US) ·

English (US) ·