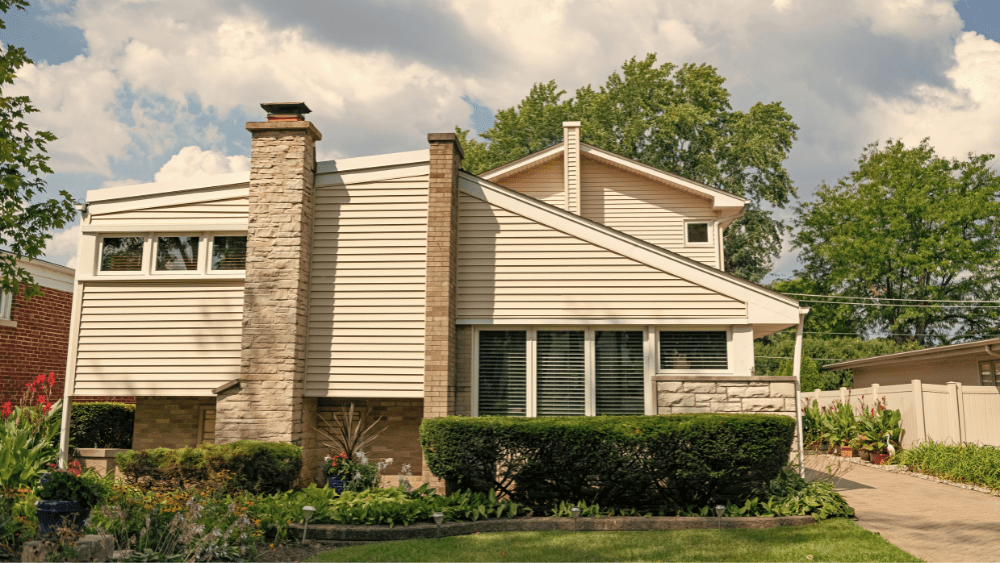

If your investment property was built after 1987 you may be able to claim depreciation on the cost of construction. Picture: Liam Kidston

If you aren’t claiming depreciation on an eligible investment property, you could be missing out on thousands of dollars worth of tax deductions each year. But what exactly is depreciation? And how do you know if it’s something you can take advantage of?

WHAT IS DEPRECIATION?

Put simply, depreciation is a type of tax deduction that eligible property investors can claim. While land value tends to go up over time, the physical assets of a property tend to degrade through wear and tear.

“You can claim the wear and tear of an investment property against your taxable income,” director of Washington Brown Tyron Hyde says.

Removal fixtures, like stoves, may be claimable depending on whether you bought the property brand new.

This is split into two parts: the structure of the building, known as capital works (such as the bricks and mortar), and the plant and equipment (things like carpet, ovens and dishwashers).

The structural components of the building can be claimed at 2.5 per cent of the construction cost each year over 40 years.

MORE: How AI will help you sell your home for more

‘Absolute chaos’: Rate cuts’ instant impact

“It has to be built after 1987 in order for you to claim it,” he says.

Older properties that have been renovated after 1987 may also be eligible for depreciation on the renovated portions.

Mike Mortlock from MCQ Quantity Surveyors.

When it comes to calculating depreciation for plant and equipment items, it gets a little bit more complicated, says MCQ Quantity Surveyors managing director Mike Mortlock.

“The ATO issues, what they call, effective lives,” he says. “For example, they say, ‘carpet has an eight year effective life within a property.’ Then there’s a formula to work out what the depreciation is each year.”

The rules were changed for claiming plant and equipment items in 2017 by then treasurer Scott Morrison.

“You can only claim deductions for those items if you bought after 2017, if you either buy a brand new property or you put brand new assets in,” Mortlock says. “So if you buy an investment property and it’s six months old, there’s actually zero claim on those plant and equipment items.”

Washington Brown director Tyron Hyde. Picture: Supplied

Those properties purchased before 2017 have remained “grandfathered,” meaning the plant and equipment items are still getting claimed.

“However, if they do move into the property for a period of time, they’ll kill the deductions from that point onwards,” Mortlock says.

HOW MUCH CAN YOU CLAIM?

To find out how much you can claim, you’ll need to engage a quantity surveyor to complete a depreciation schedule.

Hyde says higher construction costs have generally led to higher depreciation values on capital works for brand new dwellings.

“The average brand new two bedroom unit now, you would be getting around $20,000-$25,000 in the first year as a depreciation deduction,” he says. Over 10 years, the deduction would add up to about $150,000.

If you buy a brand new property the depreciation value in the first year is generally greater than that of a second hand property. Picture: Jenny Evans/Getty Images

“If you were to buy a second hand two year old property for about $800,000, you’d get about $8000,” he says. Over 10 years, the amount would be about $80,000.

IS IT THE RIGHT STRATEGY?

While depreciation is sometimes promoted as an investment strategy, both experts believe it should be seen more as a bonus rather than a strategy.

“I would never buy a property because it has high depreciation deductions,” Mortlock says. “When you see investment properties for sale and they’re mentioning depreciation it’s normally an indication that that property does not really have any sort of positive fundamentals on its own and they’re relying on the tax depreciation to try and sell it to people.”

There are different things to consider when renovating or buying a renovated property.

“I always tell people depreciation should be the icing on the cake,” Hyde says. We don’t have many people buying with depreciation strategies. They buy the property then they say, ‘Hey, can you maximise our depreciation claim?’”

DEPRECIATION TIPS

Director of Washington Brown Tyron Hyde says there are a few things to keep in mind when it comes to maximising depreciation.

* $300 rule – If buying small items like microwaves for your rental, it might be worth keeping the cost under $300 as this allows you to claim as an immediate tax deduction

* Scrapping – If renovating before the end of the property’s 40 year effective life, you may be able to claim the residual value of the old capital works in a process known as scrapping. It needs to have been rented out for a period of time before you renovate

Seek advice from a quantity surveyor to find out what you are eligible to claim.

* Seek financial advice – If you are purchasing residential investment properties under a company structure you may still be able to claim depreciation on second hand plant and equipment

* Renovated homes – If you bought a home that was recently renovated by the previous owner, you may be able to claim depreciation on the renovation. You will need to get a quantity surveyor to work out the value of the works

MORE: Seller’s shock price demand for neglected home

English (US) ·

English (US) ·